Debt is not your friend, and you should not be friendly with your debt. It’s time to end the relationship with your debt by getting debt-free. Tiny steps today reduce big interest charges tomorrow.

So let’s do something about it! To get started on this getting out of debt journey you’ll need two things. First, you need to be brave and find your sense of debt-hating desire. To get out of debt you must want to do it, badly. Don’t hide from it. Don’t feel stuck. Get into action.

Second, you’ll need bills and statements from creditors. If you’ve already listed the numbers and names in your Budget Spreadsheet (which shows your income, expenses, and what your owe) — then pull up those files. If not — no worries. We’ll get the stuff together today. Kudos.

Got debt? You’re not alone

The household debt numbers are rising across the United States and Canada, and Canadians are leading in indebtedness with a debt-to-income ratio at a record 1.71% – so for every dollar of household income there is $1.71 in credit debt. This is a BIG number, and it includes consumer credit, mortgage, and non-mortgage loans. With interest rates on the move, your debt repayments could be higher too.

Getting out of debt!

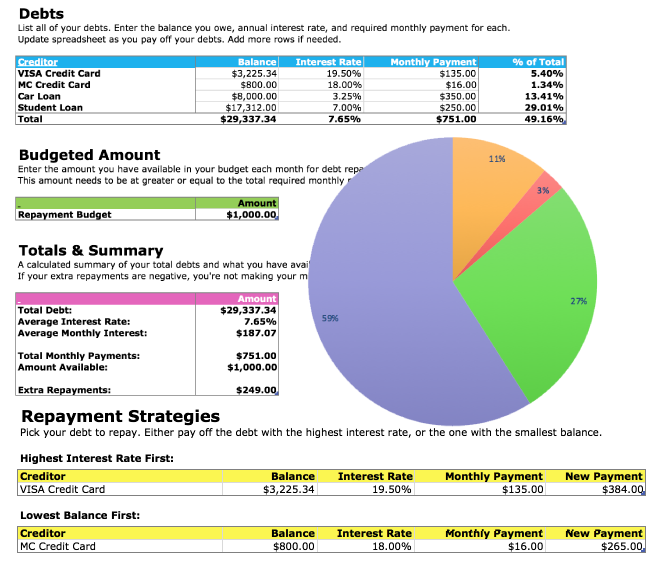

I have TWO free debt reduction spreadsheets, and both are easy to use. There’s the new one for 2023 with graphs, and there’s the original version. Both debt reduction spreadsheets calculate your numbers and give you the big picture — but a spreadsheet doesn’t do the work for you. You do the work for you.

Regardless of which version you choose, I’ve kept things super simple by listing the biggest debt-busting categories and showing you how it all adds up.

The idea is to track your creditors, list the balances due, see the interest rates on your debt, make your monthly payments, and then target one debt using an amount you have available for extra payments.

Original Debt Reduction Spreadsheet

Download: Debt Reduction Spreadsheet (original)

How to get Debt-Free with the Debt Reduction Spreadsheet

Step 1: Get the tools.

Download your preferred Free Debt Reduction Spreadsheet. All the data is stored on your end, so it’s private.

Step 2: List it out, add it up!

Take a close look at your debts. Start by listing your creditors or lenders in the left column. Then move down and across.

- Lenders: List your credit cards, student loans, HELOCs, lines of credit, and the IOU from grandma.

- Balances Due: Enter the balances due, the total amount owed to each lender.

- Interest Rates: The interest rate on the debt. If you’ve got credit card debt then you may have rates over 18%. Track it all down.

- Minimum Payments: Keep up with your minimum payments to maintain a good credit score. But to reduce debt you’ll need to increase the minimum amount to dig into the principal and pay it off faster.

With everything entered, how do your numbers add up?

Debt Reduction Example

In the example above, there’s a total debt of $274,987.45 with an average interest rate of 4.50%. The total average monthly interest is $1,031.56, and the total monthly payment is $2,596.46. The debt reduction spreadsheet helped find an additional $379.54 available to put against debt.

Step 3: Finding more money.

For those with little wiggle room in your budget for debt repayment, there are a few options. The answer is simple, but not easy.

- Cut costs: Cutting back and spending less money on your variable expenses is a surefire way to add additional dollars to your debt repayment plan. Cut repeatable expenses, subscriptions, streaming, automatic billings you forgot about. Reduce your grocery bill (buy generics, switch to discount grocers, cook at home, eat out less). See 50 Ways to Save $1,000 a Year for a few more ideas.

- Boost income: This is where you have to really want to get out of debt. Working an extra shift, freelancing, finding an off-hours gig, selling unneeded items are all tactics I have taken to boost income.

- Negotiate a lower credit card interest rate: Asking for a lower rate is free. And since most credit cards charge anywhere from 0% to 20% in interest, making a five-minute phone call could save you hundreds, even thousands in interest charges. See How to negotiate a lower credit card interest rate for the script.

In the next step I’ll deal with how to apply this extra repayment against your debt.

Step 4: Make extra payments against ONE of your debts.

Yes, you must pay more than the minimum payment on your credit cards to get out of debt. How do you choose what to pay down first? You can attack the balances in one of two ways:

Which debt to pay-off first?

Option One: Target your highest rate: Go with the mathematical reality that your highest rate debt is costing you the most money. Attack your highest interest rate debt first and when it’s paid off, move on to the next highest interest rate.

Option Two: Pay off your lowest balance: Need a mental win? Work on the card with the lowest balance to give you the psychological boost of accomplishing debt repayment. You’ll feel good seeing results quickly and be motivated to tackle the next credit card. If you have two debts with similar balances, then pay off the debt with the higher interest rate first.

Step 5: Pick a debt-free date.

Your debt-free date is the projected day you plan to pay off all your debt. Your debt-free day is projected because life comes at you fast and who knows what your income, housing, and life’s needs will look like in two to three years. Look at how much money you owe, and roughly divide your payments into months. Don’t take more than three years to pay it off, ok? You’ll feel frustrated, so aim for under three years. Write this date on your calendar. Shoot for sooner.

Step 6: Stick with it!

Whether you pick to pay off your smallest balance to start or choose to end the debt with the highest interest rate first, the point is to stick with it! Once you’ve retired one debt, move that payment to your next creditor on your Debt Reduction Spreadsheet.

And don’t forget: How to set money goals that slay and get my free budget spreadsheet.

You don’t have to track all your money, just the cash you want to keep!

More Debt Reduction Help

- Don’t JUST pay the minimum balance on your credit card!

- What order should I Pay Off my credit cards?

- How to negotiate a lower credit card interest rate

- 6 Ways an interest rate hike affects your finances

- 3 Behavioral Science Tricks to Help You Pay Off Debt Faster

These posts include TV and video too if you prefer watching over reading. I want you to succeed.

Love love love,

Kerry

Great tool for taking control of your finance!

I would add Step 9. Evaluate different scenarios and shop for different rates when you can while understanding all the penalties you would have by switching the loan. There are 2 ways to accelerate debt: more payments & lower interest rates.

This is excellent… wonderful material. I’m not indebted, but I definitely will point people in this direction who are struggling. Thanks!

[…] finally, Squawkfox posted another article in her “How to Make a Budget” series called: dig yourself out with the debt reduction spreadsheet. Now, I’m not in debt, and BenevoLance and I have a very good grasp of our finances, but I […]

When dealing with spening you should consider needs over wants. Prioritizing your debts and paying the highest interest rate off first is a good start.

Sounds good. A lot of sheets for help.

I reduced my debts by differentiating between needs and wants.

Started with paying off first on the high interest debts specifically credit cards.

This is exactly what I needed, great, thanks!

Hi Kerry,

From a financial planner’s standpoint we like to refer your site to people who we think could benefit from it. If we could somehow convince every person to do something as simple as putting some money away for a rainy day, we would have accomplished a great thing!

This is great. But can you advise on any apps that you can use for debt reduction? I was just hoping to keep track via my phone too. Thanks

is there a way to have it calculate bi-weekly payments?

Thanks for the great information Kerry. Much appreciated!!

Sounds great, but what can be done with a fixed income? A miracle!!??

Great tool! I have a clearer way to sort my finances. It does not look as bad as I originally thought! Now on to becoming debt-free!

[…] This spreadsheet by Squakfox will help you determine how much to pay off each month for each loan you have. […]

Hi! By any chance do you have a version of this that is compatible with Mac Numbers?

Hi we’re just both just starting budgeting and trying to get out of debt and then build wealth.

I am interested in how I can incorporate your wonderful spreadsheet into Numbers instead of Excel. Any chance of getting this created in Numbers? Greatly appreciate your guidance as debt needs to be tackled especially with the year that is ahead of us. Thank you!