Are you paying just the minimum balance on your credit card? You’re not alone. Around 39% of Canadians are clueless about the benefits of paying more than the minimum balance, whereas 25% of Americans are uncertain. Cries.

That’s some pretty toxic financial illiteracy with credit cards, people. I was so upset by these numbers that I took to the airwaves with CBC’s On The Money with Peter Armstrong (20:10) and squawked about how STUPID we are to just pay the minimum balance. Yes, STUPID.

A February 2017 study outlines why we’re broke while bankers are getting rich on our minimum credit card payments.

- 39% are uncertain about the benefits of paying off more than the minimum balance.

- 10% pay exactly the minimum balance.

- 47% pay off the full credit card amount.

- Canadians are less informed than Americans: In the United States 25% are uncertain about the importance or benefits of paying off more than the minimum balance versus 39% in Canada.

So what’s a minimum monthly payment, anyway?

It’s a tricky banker trick to get you to pay less than you should on your credit card. Sure, the number is low and the minimal payment seems super friendly ’cause the banks seemingly let you off the full financial hook each month, but paying just the minimum monthly payment isn’t doing you ANY favors (or favours if you’re a Canuck).

Definition: The minimum amount you must pay each month on your credit card without negatively impacting your credit score. The minimum payment is the greater of the following two amounts:

- A fixed amount. For example, $10.

- A percentage of the balance you owe, often around 1% to 3%. If you’re carrying a balance, the percentage also includes interest and fees! Wheeee!

The real tricky trick is you kinda have to read your credit card user agreement to see how your financial institution calculates your credit card cost and fees you to death to see your bottom line. You will cry.

An Eye-Opening Credit Card Example

Let’s do some minimum payment mathy math, OK?

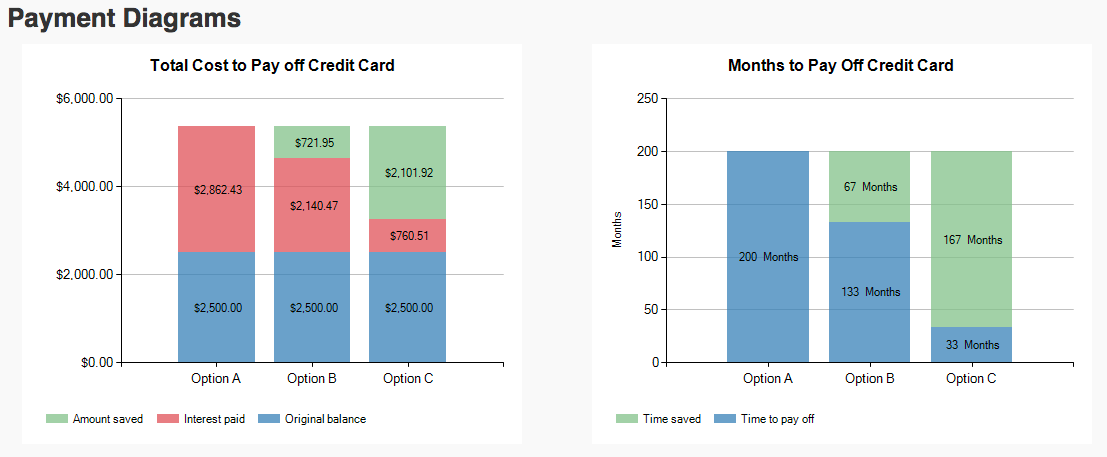

Option A: Minimum Payment

Let’s say you have a $2,500 balance at 19.99% and pay the initial minimum monthly amount of $75. Plus you never shop or add to that balance ever again.

- Credit Card Balance: $2,500

- Annual Interest Rate: 19.99%

- Initial Minimum Monthly Amount: $75

At that rate it will take you 16 years and 8 months to pay that plastic off. Plus you’ll pay the bank $2,862.43 in interest — that’s more than your initial balance for a total of $5,362.43.

- Time to pay off: 16 years and 8 months

- Interest paid: $2,862.43

- Total paid: $5,362.43

Option B: Minimum Plus

Let’s up the minimum payment a bit by dropping an additional $5 a month on the minimum payment.

- Credit Card Balance: $2,500

- Initial Minimum Monthly Amount: $75 + $5 = $80

By paying just $5 more, you’ll pay off your credit card balance 5 years and 7 months sooner and save $721.95 in interest.

- Time to pay off: 11 years and 1 month

- Interest paid: $2,140.47

- Total paid: $4,640.47

Option C: Fixed Amount

Wanna really kill that balance and save on interest? Let’s ignore the banker’s minimum (yay) and pay a fixed amount of $100 every month. Now this is magic mathy math…

- Credit Card Balance: $2,500

- Fixed Amount: $100

If you pay $100 each month instead of the suggested minimum payment of $75, you’ll pay off your credit card balance 13 years and 11 months sooner and you’ll save $2,101.92 in interest.

- Time to pay off: 2 years and 9 months

- Interest paid: $760

- Total paid: $3,260.51

Bottom Line: Choosing “Option C” gets you outta debt over a decade sooner. No wonder the banks love it when you pay just the minimum!

Graph summary from my repayment options thanks to the Financial Consumer Agency of Canada’s Payment Calculator. Try this free tool to graph your own repayment chart and summarize your options. Yes, you CAN pay down your consumer debt faster by chewing into the principle sooner and going above the bank’s recommended minimal payment. Kudos.

The Problem with paying just the minimum on your credit card

Many of us use the minimum payment as a rule of thumb. Don’t.

The many many many problems:

- Minimum balance payments leave you little chance of EVER getting out of debt.

- By following the suggest minimum, you’ll pay 2X your initial balance in interest.

- Card issuers LOVE IT when customers draw out the repayment process as long as possible, because time maximizes the amount of interest paid.

- Financial institutions boast the minimum payment in BIG LETTERS to encourage you to pay small amounts.

By boosting your minimum monthly payments, you could qualify for lower, more favorable rates and terms across all your loans — including your mortgage!

Why do we only pay just the minimum? We’re tricked!

If you’ve got more than the minimum to pay down that plastic, don’t fall for these tricks. Don’t be fooled, OK?

Trick One: Viewing minimum payments as the banker’s advice. Consumers look for guidance on what to pay. The minimum payment may be misinterpreted as advice from the card issuer. But as I’ve shown, paying this pittance of an amount is terrible advice.

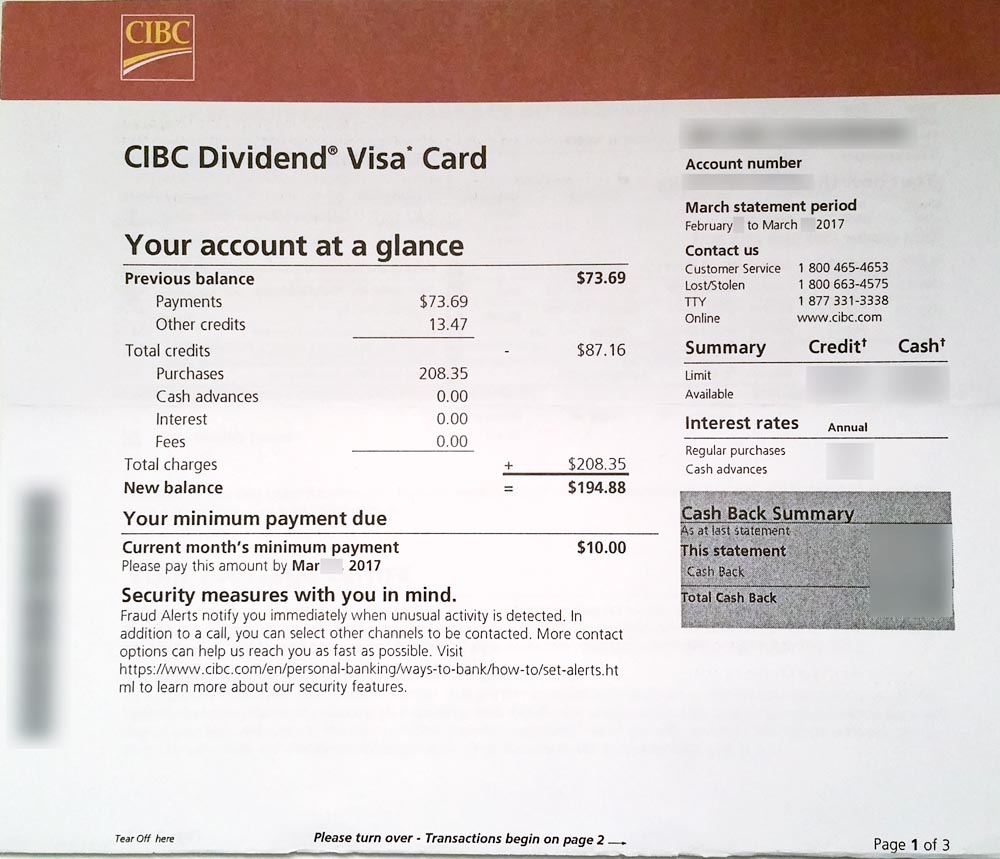

Trick Two: Anchoring and Focalism. Look at your credit card bill — what do you see first? Do you see your interest rate, spy your total balance due, or do you get hit in the eyeballs by boldly printed lower number: $10.00 Current month’s minimum payment? Take a gander at this example and tell me which number(s) pop off the page?

This eyeball spy trick is called “anchoring” or “focalism”. Anchoring is a cognitive bias that describes the ability (or terrible ability) of our brain to focus on the first piece of information offered (the anchor) when making decisions. When our brain contrasts the bigger number (total balance due) with the smaller number (minimum payment), it’s easy to view the smaller payment — which is often thousands less — as the more attractive option. Paying the minimum is also the least a cash-strapped consumer can do to prevent a negative impact on their credit score. All of these brain-boggling factors can influence us to focus on the minimum and bias us against paying even a little more.

The fantastic Penn Wharton study, Perverse Nudges: Minimum Payments and Debt Paydown in Consumer Credit Cards (pdf) explains why our brains need a cognitive reboot when we deal with credit cards.

Trick Three: We see rates as fixed.

Interest rates are NOT fixed. If you’re in good standing with your card issuer, chances are your rates are flexible if you ask. In How to negotiate a lower credit card interest rate, I share a simple script for calling up the plastic police and being brave enough to ask for a rate reduction.

If they say “NO”, call back in a week. Tell them you’ve been paying the minimum and have been a good customer. Check competitor’s rates and other credit cards. Negotiate.

So where am I going with this?

I could have written this whole dang post by simply saying:

Paying just the minimum on your credit card is BAD.

Paying more than the minimum is BETTER.

Paying off your credit card balance is the BEST.

But sometimes a kick in the butt with the mathy mathy is what you need to be your bestest with credit.

Or you could just watch my credit card segment on CBC’s On The Money with Peter Armstrong — my clip starts at the 20:10 mark.

Love love love,

Kerry

Speaking of banks & fees. I’m trying to avoid paying over $20.00 monthly chequing account fees ( and that’s with a $7.50 refund if our monthly balance is over $3,000!)

What’s your opinion of using a credit line account instead? ( which I read about in the Comments section of someone in Money Sense Magazine last year)

Seriously tired of paying bank fees and tying up large sums of money with no interest…

Hi Norma! First off — HOLY HECK that’s an expensive chequing account AND they hold your money hostage! Yes, it’s time to fire your bank. There are NO FEE accounts with Tangerine Bank and PC Financial (I don’t work for any of these banks BTW). Try this Financial Consumer Agency of Canada’s Account Selector Tool (http://itools-ioutils.fcac-acfc.gc.ca/STCV-OSVC/acst-osco-eng.aspx) and read my post: Fire your bank with the Switch Bank Accounts Checklist (https://www.squawkfox.com/switch-bank-accounts-checklist/). If you’re a senior or student you should qualify for a free chequing account at many of the BIG FIVE banks, but you HAVE to ask for it! I’m angered by your high fees — Fire the jerks! Love, Kerry

I was with PC for 10 years until I moved to Quebec (they don’t operate here) and now I’m with Tangerine! I certainly vouch for both!!

Paying the minimum balance is definitely a set up for failure and its beneficial to the credit card companies.

In general I think it is best to pay down debt before taking on any credit. I know this is simple and say to say, I think if people thought about this before they get too far in debt it would be easy. Debt interest rate is generally much higher than you can make in stocks or on your home if you own one. I think it is best to sell assets to pay of debt. It psychologically is freeing and makes life easier. Then you can build investments back up once debt is cleared.

There is nothing wrong with paying just the minimum payment especially if the interest rate is very low. If you are fortunate enough to be offered a rate as low as 3.00% I would not be in a hurry to pay off the balance. There are times when you have to pay just the minimum until you can increase the monthly payment or pay the entire balance.