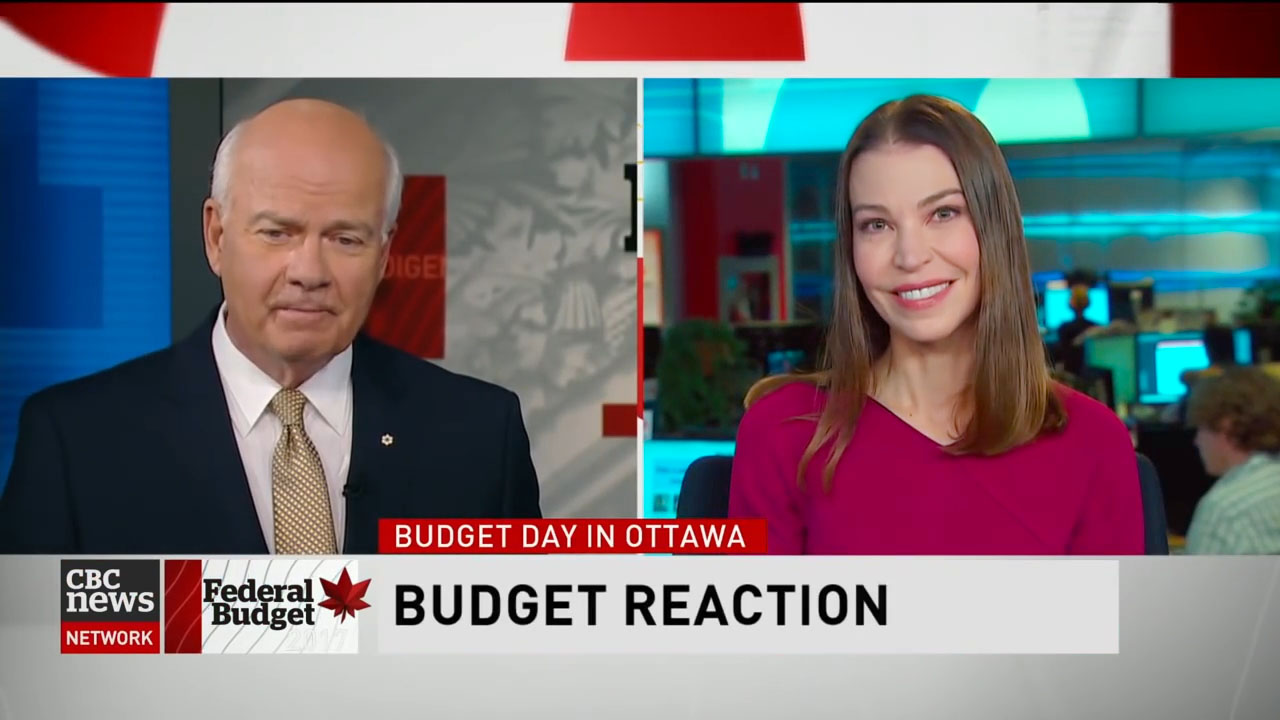

You Might Have Seen Me On

Add The Cash and Kerry Newsletter to your inbox for free. You’ll get weekly motivation, smart financial explainers, plus my FREE Budget Bundle.

“If you want someone amazing in your corner, pick Kerry.”

“If you want someone amazing in your corner, pick Kerry.”

— Podcast Listener

Kerry might be the world’s most engaging financial writer. Her relatable and humorous style brings freshness to a genre that badly needs it. If she says something, it’s always worth tuning in.

Squawkfox is a wonderful site. She’s a woman after my heart, combining insightful savings tips and a nice sense of humour.

Squawkfox is like having a smart, self-sufficient friend who is generous with good advice. Writing the blog has helped make Kerry possibly Canada’s foremost voice in frugal living.

Kerry might be the world’s most engaging financial writer. Her relatable and humorous style brings freshness to a genre that badly needs it. If she says something, it’s always worth tuning in.

Squawkfox is a wonderful site. She’s a woman after my heart, combining insightful savings tips and a nice sense of humour.

Squawkfox is like having a smart, self-sufficient friend who is generous with good advice. Writing the blog has helped make Kerry possibly Canada’s foremost voice in frugal living.