During this time of the COVID-19 global pandemic I’m most concerned about everyone’s health. But while COVID-19 didn’t start as a financial crisis, it’s certainly evolving into one.

CBC The National asked me to talk about personal finance during the coronavirus pandemic and what that means for families, students, seniors, and you.

I was on a panel of finance experts — including Tim Cestnick and David Sung — answering viewer questions about coping during the COVID-19 pandemic. We answered small business questions too! My apologies to my international readers — the panel’s answers are directed for a Canadian audience, but I’m certain there’s something in here for everyone.

Not all our answers made it to air, so I’ll include the answers to a few additional questions below!

This is my first television appearance since cancer treatment. It feels good to be back, guys.

BTW: If you have any money questions, please ask away. I’m here for you.

QUESTION 1: Many people live paycheque to paycheque. How are they expected to survive while waiting on benefits to kick in with little to no savings put aside?

Kerry’s ANSWER: This is a big question. Making ends meet was challenging for many Canadians before COVID-19. It’s truly survival now. Here’s what to do…

- Step One: Your health is your wealth. First and foremost, your health IS your wealth. I want you to focus on getting food on the table prescriptions paid for and staying healthy mentally and physically. Your health and staying safe is your first priority.

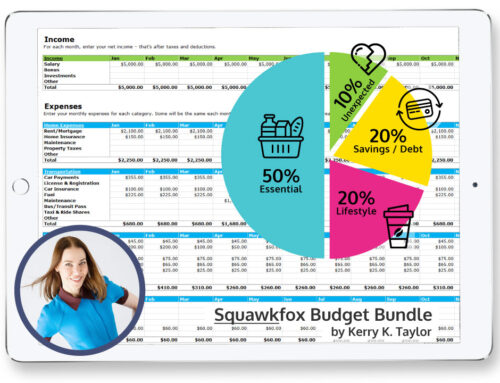

- Step Two: Create a quick mini budget. List your bills, list minimum payments on credit cards, lines of credit. Call your lenders and service providers and ask for financial relief and/or financial deferrals. My preference is for everyone to avoid payday loans as a stop gap measure — borrowing $400 dollars today can quickly turn into owing $500 or $600 a few weeks from now. Payday loans will just make a hard situation even harder. Download a free budget spreadsheet here.

- Step Three: Increase cash flow. Apply for Employment Insurance (EI) or the Canada Emergency Response Benefit (CERB). The CERB pays $2,000 a month for up to 4 months. It’s for self-employed individuals who are not eligible for EI, it’s also for parents who must stay home without pay to care for children. You need to have earned at least $5,000 in 2019 or in the 12-month period preceding a CERB application to qualify. You can apply around April 6th. Apply for the CERB.

- Step Four: Before it gets really bad. A conversation with a Licensed Insolvency Trustee can be a positive step. They explain all your debt relief options — plus getting collection agencies off your back. You may be surprised how positive a step this can be. Talk to them before talking to the payday loan people.

QUESTION 2: Should we withhold our rent for April? We could pay now but I’m worried we won’t have any money in May.

Kerry’s ANSWER: April 1st is rent day and a lot of people are asking me this exact question. Most provinces have halted or suspended evictions. The courts are closed so you’re unlikely to get evicted. However, COVID-19 is not a rent holiday. Here’s how to deal…

- Step One: Boost cash flow. Families with children may qualify for the temporary $300 boost per child for the Canada Child Benefit (CCB). This boost is scheduled for May with the regular CCB payment. Apply for Canada Emergency Response Benefit (CERB) — see above. Check for rental supports in your province. British Columbia just announced a $500 rental subsidy which goes to the landlord. Other provinces may follow — things are changing fast.

- Step Two: Update Banking. Go to your CRA My Account today and update your banking information so you get a direct deposit. This money will get to you faster by bypassing the mail. You’ll also avoid an awkward situation if you share a mailbox with your landlord.

- Step Three: Quick mini budget. Look at what you have for rent month this month. Total your bills, minimum debt repayments. Figure out your wiggle room before calling your landlord. Download a free budget spreadsheet here.

- Step Four: Contact your landlord. Tell them you can’t work because of COVID-19. Ask what your landlord can do – are they flexible? Depending on their own financial situation, your landlord may be willing to offer some rent relief. Pay what you can – this isn’t an all or nothing situation. Offer some payment until you qualify for federal aid. Keep good will on your side. Set up a repayment plan moving forward. Things are changing fast.

My friend Rachelle over at LandlordRescue wrote a COVID-19 Tenant Guide: No Rent! Negotiating. It’s packed full of help for renters looking for some advice.

QUESTION 3: As a senior, I may not be able to wait for my investments to rebound before I need them. Should I cash out a portion of my investments?

Kerry’s ANSWER: For younger investors I keep saying: Your RRSP is like your face — don’t touch it. But don’t wash your hands of it either.

The markets are in flux and investments are down. We humans are wired to feel The Fear Of Losses stronger than the Joy of Gains. So closely watching your portfolio will make you feel worse. If you can’t sleep at night, I’d suggest you consult with a fee-only advisor — they don’t sell products, just advice. They will look at your portfolio, your goals, your needs, and can help you decide what to keep, sell, and what to do. The answer might be — do nothing.

A fee-for-service certified financial planner can help you make sure you’re not making decisions based on emotions, especially when it comes to your financial health.

Question 4: I was a full time student without income, but now my spring/summer employment that I rely on for tuition is in jeopardy. Is there any government support I should know about?

Kerry’s ANSWER: Students and new graduates are in a blind spot for the new emergency package.

The good news is students who had income, summer jobs or part time work, of at least $5,000 in 2019 or in the 12-month period preceding the COVID-19 crisis should qualify for the Canada Emergency Response Benefit (CERB).

New graduates without previous income who have a job offer lined up for May will be hard hit by this crisis. The silver lining is Canada Student Loans and some provincial loans (OSAP) are suspended or frozen for around six months. So no repayments are required and interest will not accrue.

—

Got questions? Shoot me an email or ask in the comments below.

Love love love,

Kerry

I saw your CBC show and was happy to have you back. So far I am fortunate since I receive pension money and also work part time in health care. My biggest problem is trying to reduce my tax burden as I have almost no deductions. This is a conversation for later once the crisis is over.

Delighted to see you are back. My wife has just gone through a winter of chemo treatments and is recovering nicely. So we were self isolating all winter. Nice to see spring is coming. Be strong. We will get through the virus and enjoy Squawkfox again!

Welcome back Kerry — Stay Well!

RDSP question

Will adjustment be made to the formula used for LDAP ?

Hi Kerry!

So happy to see you back. Quick question. My husband made $10,000 last year. Unfortunately he got VERY sick from October to January and had to resign from his job. He Was better mid February and was looking for work…and then COVID 19 happened. Does he qualify for CERB? If not what should we do? I’m currently on mat leave with baby #4. Should I look into doing a “side hustle” while at home?

Great to see you back on the horse Kerry! Keep doing what you do.

Hi Amanda, Your husband should apply for the CERB. The CERB is available to workers who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application. Here’s the link: https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html#who

Stay safe with your family.

Good to see you again, with energy and assurance in your voice, not to mention the wise and helpful content! Thanks for posting your answers to the questions that were not directly put to you on The National.

Hi Kerry

Glad to see you up and well, I have looked for a fee only advisor in Nova Scotia, but have difficulty finding one and then have no idea if they are any good when I do is there a list of accredited ones?

ll of these things are so important, especially investing in yourself. Once you realize that the work you put into yourself can have exponential returns far greater than any investment, it will force you to never stop learning. Sky is the limit at that point 🙂

First off, I am glad you are doing better! What a time to be alive, am I right?

This post was enjoyable to read, especially finding out how our neighbors are handling this financial shock created by the coronavirus (I’m an American). You have done a great job of breaking it down for Canadians. Well done.

One thing I caught from this post is how to handle the markets. There is no doubt that humans are wired to feel fear. I agree completely that acting on emotions are an investors enemy!

I am glad you’re back at it, and wish you the best health and wealth!

I was watching the CBC show and was so happy to see you there. All these tips you have mentioned and explained are really important and useful. Just like always, keep sharing!

First timer…thanks for sharing knowledge on a subject (money) which we did not all grow up with or learning about but we sure knew to spend it. Hmmm I hear the ice cream truck.

Good ideas on dealing with money matters during the pandemic. Great tips!

Love your comments about boosting cashflow! Also great content and blog! You are an inspiration to me ☺️. Keep up the great work!