Who needs a blazer with a human spine and ribcage painted on the back? OK, maybe me. And possibly the woman who first owned this bizarre yet gorgeous Alexander McQueen piece of now second-hand haute couture. My friend Nadine was nearly as taken by the weirdness of the almost-business blazer when I tried it on in a fancy consignment store.

“It’s really cool,” she said. “But where would you wear it?”

This photo fails to do the Alexander McQueen blazer justice. Wish I had snapped a shot while wearing it. Sorry.

I got all dreamy and envisioned myself at a fancy cocktail party. In my mind I had paired the sexy skeleton jacket with a svelte pencil skirt and was standing tall in 4-inch stilettos while sipping a flute of champagne. The tailoring of the boney blazer was sublime with the peplum hem, the cinched waist, and the strong yet feminine shoulder. Yes, the spinal tap of couture coats belonged in my wardrobe.

Then reality hit and I grew a spine. The only thing I sip these days is coffee, and I often spill the brew on my not-so-haute hoodie while chasing a toddler in runners around the playground.

My fashion fantasy revealed a haute hallucination, and the once cool skeleton jacket looked less like couture and more like a carcass. A sweep of reality and a glance at the price tag killed my blazer boner. The jacket went back on the shelf.

Nadine nodded. I laughed. We both know that quirky clothing is my Achilles’ heel, my trigger for impulse buying. OK, I dream of denim and I have a thing for wacky shoes too.

Impulse buying is the achilles of saving money, said @PeterAceto @TangerineBank #raaa15 pic.twitter.com/ck4TXojmkb

— Kerry K. Taylor (@squawkfox) May 15, 2014

But despite my irregular heart flutter for frivolous fashion, I’m a disciplined saver. The reason I’m able to act against impulse is I know my spending tick and I’m very aware of how marketers convince consumers to part with their cash.

You can do it too. Here’s how:

1. Know your spending impulses.

What’s your weakness? In 2012 BMO released a report on the ‘Psychology of Spending’ and found the most common impulsive purchases made by Canadians are pretty common. Go figure.

Where we impulsively spend our money:

- clothing (57%)

- dining out (52%)

- shoes (39%)

- books, magazines (38%)

- music, movies (31%)

- technology, gadgets (19%)

I’d add chocolate to the list but I’m not going to admit publicly how much chocolate I impulsively buy and consume. OK, a lot.

Think Twice: Do a mental checklist and then check your receipts. What are you buying with little or no thought? What stuff have you purchased but don’t need? If you’ve impulsively bought an Alexander McQueen skeleton blazer, please pair it with a pencil skirt and send me a picture — I’ll live vicariously through you.

2. Admit your shopping triggers.

What’s motivating you to walk into a store or click the ‘Buy Now’ button online, and then check out with an unplanned purchase?

Moody Blues

If you’re like many impulse shoppers you’re probably making an emotional transaction for a little retail therapy. Shopping may improve ‘The Blues’ in the short term, but the adrenaline spike has sparked long before the credit card bill arrives. Racking up debt won’t help you feel better in the long term — we all know this.

Think Twice: If you’re feeling low, avoid stores and online marketplaces and go for a walk instead. Telling yourself “I’m just window shopping” or “Trying it on is free” are gateway excuses to future debts.

50% Off

Stumbling upon a ‘SALE’ is another trigger for impulse shopping. Few can resist something that costs less today and hits a higher price tomorrow. You don’t want to ‘miss out’ after all.

Think Twice: Skip the sale and tell yourself there’s always another bargain around the bend. Just because an item is ‘on sale’ doesn’t mean it’s a deal, and doesn’t mean you need the thing either. Besides, it’s not savings unless you’re actually saving money.

Smells like teen spirit.

I’ve never understood that song, but you may just hit spending nirvana if you walk into a place where stuff smells so good you can’t resist buying it. Movie theatre popcorn comes to mind, but I like the scent of some makeup counters and stores too. Don’t let me loose in Sephora. Ever.

Think Twice: Snub your nose at the world of wonderful smells when something delicious prompts you to spend. Being aware of how you react to scintillating scents can help you curb impulse spending.

Reality Bites.

Clothing, cars, and carats (yeah, jewellery) are all products marketed with consumer lifestyle inflation in mind. The right ride and the perfect dress can make your life richer, right? Nope. Just poorer.

Making an emotional connection with something lovely or luxurious and seeing that product as part of your life is a key tool marketers use to sell you stuff on impulse. Who doesn’t want to be the gal in stilettos sipping champagne while wearing a skeleton blazer? Put your emotional dream sequence into perspective and leave that item in the store where it belongs. There are no skeletons in my closet. Sniff.

Think Twice: Put off the purchase for an hour, a day, and then a week to see how impulsive you feel after the adrenaline rush has left your brain. Walking away is free and you can’t regret the purchase if you don’t buy it.

3. Do the mathy math.

The BMO ‘Psychology of Spending’ study claims Canadians spend an average of $3,720 a year on stuff they want but don’t need — that’s $310 a month or $10 a day. My guess is the number is higher. Splurging on a larger house or a newer car can up that number neatly.

Think Twice: To find your impulse spending number add up the random meals, clothing, and gadgets you’ve purchased and tally the total. How much could you have saved? Visualize your life with less crap and more saved up cash the next time you get the impulsive itch.

4. Prioritize the needs, save for the wants.

I created the Should You Buy It? flowchart because I like decision trees, lists, and prioritization. Yeah, I’m a party girl. Anyhoo, I’m a huge fan of ordering my needs in a priority spending list and moving my wants to a ‘save up for it’ list. It’s hard to get impulsive when a shopping list tells you how it is.

I’m not alone. Last month I attended Gail Vaz-Oxlade’s ‘Stop The Holiday Madness’ event where she helped attendees avoid consumptionitis over the holidays. The talk was fun and I couldn’t help but live tweet some of Gail’s wise words.

When you become conscious about your spending you become connected with your money. @GailVazOxlade #gvoblackfriday

— Kerry K. Taylor (@squawkfox) November 29, 2014

I liked this comment best, probably because I like art.

"We have lost the art of enjoying the wanting. When we let wanting equal getting we replace our life w/ consumption." #gvoblackfriday

— Kerry K. Taylor (@squawkfox) November 29, 2014

When was the last time you savoured a purchase because you wanted it and saved for it?

Think Twice: Read what Gail said again. Now embrace the art of enjoying the wanting.

5. Avoid the Impulse Zones.

Avoiding the stores is the first step. The second step to get wise to what I call the Impulse Zones.

The Checkout.

Paying for stuff is the law. The problem is many stores hide their cashiers at the end of a maze lined with tall walls of impulse stuff to buy. In these stores I often feel like a lab mouse seeking the cheese in a science experiment determined to get me to nibble on something else to buy. You better believe there’s a camera (or two) watching your every move, optimizing the maze for the next consumer. Nibble. Nibble.

Check out this maze of a checkout. Where’s the cheese?

Walking though the checkout maze I see gadgets. I also see a lineup of distracted husbands impulse looking at gadgets.

Perfect. Kids’ crap at the perfect height for kids to give a crap. Good luck dealing with that tantrum.

Chocolate! OMG! Stop me! I thought I was looking for cheese? Where’s that skeleton blazer?

Water bottles. Yeah, after getting the husband past the gadgets and the kid over the toy-induced tantrum, I think I’m thirsty. Does this lineup serve wine?

I give up. I’ll get the wrapping paper. Grumble.

Think Twice: Navigating through the costly checkout maze without looking, smelling, or touching anything designed to taunt your senses is impossible. But if you focus really hard on the cheese (the cashier) you can win the impulse war. Just leave your kids at home. Oh, and don’t impulsively buy the wrapping paper just because the maze wore you down. Show the maze who’s boss.

Displays

Product tables, aisle displays, and humans standing in your way are all tactics stores employ to sell you stuff on impulse. When I walked into Baby Gap the other day, I was first greeted by a human who listed the menu of Gap sales. I then watched a customer handle the stuff on this table.

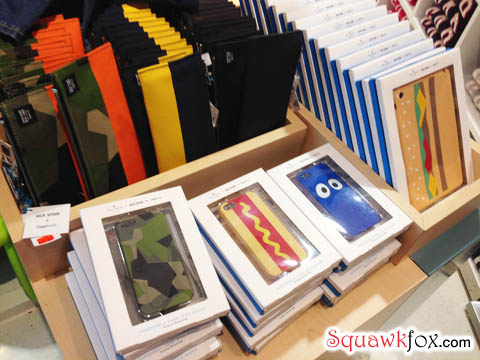

That’s a hot dog hardcase for an iPhone. Who walks into Baby Gap with the intention of buying a hot dog hardcase for an iPhone? After handling the phone case, that is exactly what this customer bought on impulse.

Signs promoting sales, discounts on multiple items, and loyalty awards can hook impulse shoppers too.

Think Twice: Smile at store greeters and skip the hot dog iPhone hardcase unless it’s on your shopping list. Being aware of table displays, signage, and even how the lure of loyalty points can prompt an impulse purchase can help you think twice before spending. I’d rather collect real money in my savings account than loyalty points on a card any day of the week.

The wandering labyrinth.

Surviving a trip to IKEA and deciding if shopping at Costco is really worth it depends on your ability to wander through the warehouse labyrinth without impulsively buying extra crap. Stick to your shopping list and you’re good. Succumbing to IKEA’s ‘Market Hall’ or Costco’s everything (what isn’t good at Costco?) is bad for your bottom line.

Stores like IKEA and Costco know how to get you to impulse spend by forcing you to wander the aisles, interact with the installations, and even taste the samples. Who can resist Costco’s free samples? These places present temptation zones for impulse shopping at every turn.

Think Twice: Taste the samples and put your feet up in a POÄNG, but stay strong when you feel enticed by stuff you suddenly want and don’t need. Your quick trip to IKEA could end with a U-HAUL delivering a new dining room table and chairs.

6. Grow a spine, nurse your Achilles.

Impulse buying is the Achilles’ heel of saving money. If you’ve ever had a sore back or hobbled around with Achilles tendinitis, you’ll have a good pain point to imagine how your credit card looks after an impulsive shopping workout. It hurts. Leaving something unbought in the store may hurt initially, but seeing your savings grow longer term feels amazing.

So next time you spy something pretty on a display table or try on a snazzy new thing to wear, tell yourself to grow a spine, acknowledge your Achilles weakness, and leave the stuff in the store. The next impulse shopper won’t thank you.

Your Turn: What’s your impulse shopping weakness?

Love,

Kerry

I can easily put the snob on in most stores, but I’m the sucker marketers dream of on Ebay, Amazon, Costco, & Sears Tools. Curse those amazing must-haves now called ‘clutter’. I’m so weak.

the coffee bars. May it be a the grocery store or right next door. 5 bucks lost….

6-1/2 years ago, I had consumer debt of $46,530.37… yep, now turn that into how many pennies or even nickels! Interest being paid at that time was approximately $275 a month. I’m happy to report that I am $4600 (at 0%) away from being consumer debt free and it will be paid off before I feel somewhat comfortable with retirement, perhaps next year. As Tony Robbins taught me, we change either because of pain or pleasure. I had enough pain to make the change, and don’t go thinking I don’t get “the urge” to spend. It’s still there. And the pain of paying it back versus the pleasure of being debt free really reminds me what I need to do. Check out the needs and the wants, and saving for the wants is where it’s at. Thanks for the reminder, Kerry! I’ve managed to buy the condo I rented for 16 years, added to my RRSP, gone to Europe last year for three weeks, and the Maritimes this year, updated my bathroom – all paid for and still have money in the bank. It’s a discipline I can live with. And for sure, check out the triggers of spending. You won’t be loved any more by anyone if you buy them an expensive gift because if that’s the case, I suggest you scratch them off your list, and perhaps out of your life. Strong words, but think about it. Merry Christmas everyone, and to those who don’t celebrate, do enjoy the holidays!

I love Costco, but have to agree that you need to be alert. I think you described Costco once as the store where you go in for groceries and come out with those PLUS a garden shed. Happens to us all the time. First the garden shed, then the patio set, finally (until next time) the big screen TV. At least those big items don’t come shrink wrapped in pairs!

Thank you for this post. I have been careful and tried to purchase wisely this Christmas, but it’s very tempting to succumb to all the promotions by companies that want to take my money. I told my boyfriend that I’m going on a spending “fast” right after Christmas. No more buying unless it’s something I need to survive. If I feel that restless need to acquire stuff, I’ll go to the library and bring home FREE books, DVDs, and CDs. I’m saving for a trip to Europe, so I do have a good incentive, but we should all go on a spending fast once in a while and see how much money we can accumulate!

Wrong metaphor, Kerry. “Achilles heel”, not “Achilles”, for Zeus’ sake! Achilles was the Superman of the Trojan War, the man who could do anything, invincible in battle. Hardly a guy you or your source ought to name as an example of weakness. But as a baby Achilles had been dipped in sacred waters by his mother to assure his invincibility. She held him by the heel, which remained dry and did not get super powers like the rest of his body. There, this otherwise Superman was vulnerable and could be wounded. Impulse buying is the Achilles heel of sound financing.

I wish I had a cool jacket I could pass along to you to wear with your pencil skirt! I asked around and ended up borrowing a beautiful gown from a student at the University I work at, rather than buying one for a one-time event gala I was asked to attend. My downfall is clutter from the Value Village (which isn’t such a deal these days if you compare new vs. second hand)…I have found worn, non-logo t’s there for $12. when I can buy new for under $10. at Walmart. Alas, I have started with the mentality that I have no room for more junk…helps cut down on more clutter.

My weakness is books because I believe there is something inherently wonderful about books. Also the dollar stores get me snatching stuff off shelves but at least you can return things.

Glad you mentioned the loyalty rewards cards as marketing ploys that the stores use to get you to leave more money in the store. They are the ones who get the rewards not the consumers. I just learned to ignore them. A bit of a time saver too. I would just love to see your take on the wasting of time. It’s your money or your life. Time is money. What you think?

Peter Aceto meant “Achilles’ heel”…

My weakness is clothing, however, regularly reviewing my woefully tiny closet and organizing items every season helps me weed out what I don’t wear and not buy more of what I already have (too many red t’s).

RE: Value Village – treat it like a specialty store, not like Walmart. Be shrewd and only buy what you absolutely love – the like new Tommy jeans and wool Dalmys hoodie I got at VV fit better and will last longer for less $ than brand new jeans and sweater from Walmart. For me, a nifty-thrifty wardrobe lifter can curb the itch for bulk retail therapy. And there’s beckoning candy aisle at the checkout.

Updated. Thanks Margaret.

My weakness is fast food. Even when I don’t really want it.

That jacket truly is “A Nightmare Before Christmas”;so sure I have spotted a men’s t-shirt somewhere with the same design and I think it was something to do with dirt biking.Glad you avoided that purchase.

I worked retail for about 12 years–I know all the pitfalls & strategies. When district managers were pushing us to sell soon to be discontinued or seasonal stuff I was always the one selected to write the signs, make the displays and position the items. The store I worked at always sold out of those items before the second markdown. So when I see all that stuff, I just laugh and pass it by.

My weakness–cooking gadgets –pitiful–((smh)) ((shaking my head))

My husband’s impulse buys? DVDs and toy cars for our son. I had to talk him down in Walmart as he loaded our cart with 22 Hotwheels! Yes, they were on sale for 94 cents each…but do we need 22 of them? Mine is A.C.F.D…Anything Cute From Dollarama:) Yes, it’s only a dollar or two, but these little loonies soon become $20 of adorable stuff. As frugal as we are in our purchases, we have to remind ourselves that even at the dollar store every dollar adds up.

Hi, Kerry, I am only a sucker for impulse buying these days at the bookstore and the movie theatre. I love to go to movies – about 25 a year. However,I can justify this because for every 10 movies I attend, I get a “free admission” to a movie. This is the SCENE card plan offered by Cineplex in Canada. I recommend it to everyone. Another way I control impulse buying at the movies is to buy the kids’ snack pack or just a cup of tea if it is available. Dinners out can also be a pitfall, but I am getting around that too, by learning how to COOK more delicious stuff at home. Shoes and clothes, not any more.

[…] Kerry K. Taylor shows us why impulse shopping is the Achilles’ heel of saving money. […]

I actually make a game out of trying to find and use all of the hidden shortcuts in IKEA to get both to the area where I want to find the item I already know I want to buy and to get safely back out and through the checkout. Hint: start by going through the door to Smaland and then….

It feels like living a quirky episode from the Man from Uncle or Get Smart and it makes shopping there much more pleasant.

I remember when I pay, I think: Are you sure?

I definitely have a weakness for impulse buying as well. I come in just to grab milk or bread or something, and on the way end up finding the perfect blouse or accessory or something…! It takes a lot of mental fortitude ahead of time to be able to go in without grabbing something I don’t need.

[…] from Squawkfox reminds us that Impulse Buying is the Achilles of Saving Money, something to remember when you pick up that deluxe cheese straightener you have always […]