Is it worth it? That’s the number one question I get asked. Should I buy this thing or that thing? Is this a deal or a ripoff?

Is a purchase worth it?

Over the years I’ve attempted to answer this question many times with varying results. I’ve pondered if shopping at Costco, switching to generic over-the-counter drugs, using a Diva Cup, or opting for cloth diapers are worth it?

The truth is I don’t always know the right answer for YOU because I have little insight into how you value your time, your money, and the items you seek to buy.

This truth hit home the day I asked if the $900 Canada Goose winter parka was worth it. The internet lost it’s mind.

The debate was passionate. On one side, the naysayers said the coat was too expensive. These folks argued you could buy a comparable coat for less and the steep price reflected the exclusivity of a luxury brand, not the quality of the materials.

On the other side, the yaysayers said the parka was worth it. Coat owners loved their parkas citing quality, attention to detail, made-in-Canada credibility, and how it kept them warm in a variety of cold climates.

When my blog story was picked up by the Globe and Mail and became a news story, I knew Canadians cared about the cold, sure. But after thousands of comments across social media debating the quality, longevity, luxury branding, and cost of the parka, I realized we had all missed the point.

No one thought to measure the parka’s cost by the hours they needed to work to earn it.

Back on an organic farm where I lived with my family for 7 years, my father-in-law Ralph — the Boss of the ranch — measured an item’s cost with the cattle he needed to sell to buy it.

His financial perspective changed how I thought about spending and whether something was worth it.

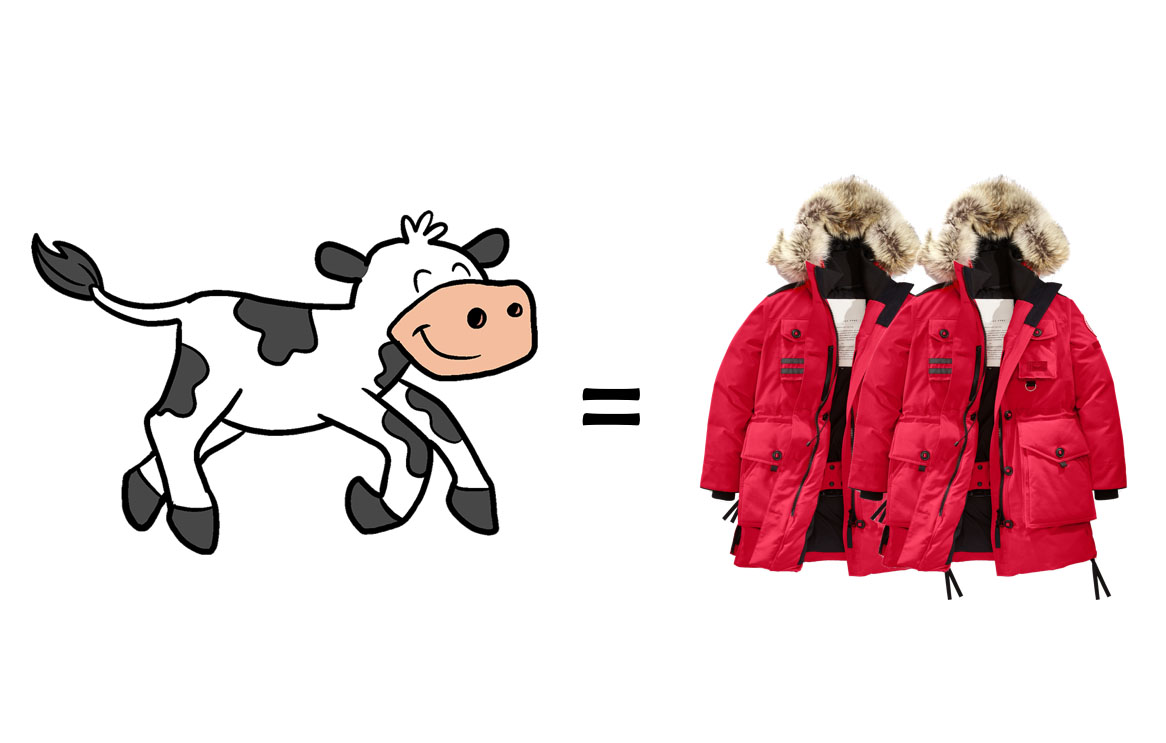

In farmer currency he can buy two Canada Goose parkas for one calf.

Or he can sell 88 bales of hay for one parka.

Now I realize that hay bales and cattle are unconventional currency metrics, not unlike Bitcoin. So let’s look at city dollars.

Here’s the “Is it worth it?” calculation:

| Salary: | $60,000 |

|---|---|

| Net: | $48,000 |

| ÷ 52 weeks, 40 hours/week | |

| Hourly Rate: | $23/hour |

Let’s say you earn a really sweet salary, perhaps $60,000 per year. You don’t get to keep it all because of taxes, so you net (take home) around $48,000 per year. If you work 40 hours per week your hourly rate is $23, which is well above minimum wage here in Canada.

Question: How many hours do you need to work to buy the coat?

Answer: 39 hours

That’s the true cost of the coat.

Even on a substantial income you must put in a week of full-time work to buy this coat.

Mental Accounting and “Is it worth it?”

Because money is an abstract concept – it can be a piece or a paper or a digital number in your bank account — I want tie money to something tangible. That’s your time, your life. It’s a valuable method because studies show we don’t treat all our money equally. Ask yourself this question:

Which is easier to spend?

- Birthday Money, from your grandmother.

- Job Income, from your pay.

It’s easier to spend the birthday money because we view it as a windfall.

What I did here with the birthday money was apply a concept in behavioural economics called mental accounting. Mental accounting (or psychological accounting) tries to describe the process where we categorize and have multiple accounts for the same resource — your money. For example, you may use different monthly budgets for grocery shopping and eating out at restaurants, even though both expenses draw on the same resource — your income.

Mental accounting was first named by Richard Thaler, winner of the 2017 Nobel Prize in Economics and author of Nudge: Improving Decisions About Health, Wealth, and Happiness.

By being aware of how we treat our money differently through mental accounting — whether it’s a job bonus, birthday money, or our weekly income — and by tying money to time, you get a more valuable, more personal idea of an item’s true cost. And this can help you make better spending decisions.

Love love love,

Kerry

P.S. I invented a term for impulse spending at the grocery store — it’s called the Fluff Factor. To combat these “Fluff” purchases go ahead and use your hourly rate to see if spending this extra money on food is “Worth it!”

Measuring worthiness by work hours is not a new idea for me. The first time I heard about it was in an audio book called “Your money or your life ” by Joseph R. Dominguez and his colleagues. It’s a good approach and I do this quite often myself but this alone is not enough at least for me. I try to live a frugal life and when it comes to buying a new thing I think a lot about not only how many hours I’ll have to work for it but also is this item is necessary (I hate to have too many things) for me, how much this item will make my life better, how much I would pay if I would by it second hand, are there any alternatives and how much they cost. My way takes a lot of time and energy but I save myself from clutter, save some money and time (of course some of it is wasted on the research).

I’m terrific at “Fluff” purchases…everywhere…and if it’s a really great sale price?…. I might end up buying 2! Have tried various things to combat impulse buying, but “Worth It” just might work. I’ll try, thanks much! (Usually the only way is to just not go shopping.)

Back in the 1970s, my wife and I were into tennis, and I was into old cars.

We worked through the notion of spending $100 for a really good tennis racquet.

Then I found an old sports car that I wanted to get – a Shelby Cobra for only $15,000.

My wife wisely pointed out that that was equivalent to 150 tennis racquets. Well that slowed me down, but also helped to put the cost of the car into a different light, and we laughed, but didn’t buy the car.

We have remembered that experience and still will recast the cost of things we want (but don’t really need) in terms of tennis racquets.

Your suggestion to use hours worked is a good one.

Cheers

Although I was already familiar with this concept, your post explains and illustrates it very well. One area where it seems not to apply so well is in the repeated purchase of many small items. For example, a relative of mine recently purchased a Christmas dog collar for her dog (why does a dog need this?), which was “only” an hour of work for her. The problem is that many such smaller purchases can add up to the equivalent of that Canada Goose parka, but does so in a way that slips under the radar because each small purchase seems like no big deal.

Kerry, if you can find one, how about a framework or method for making far-off, intangible purchases as real as that jar of fluff in your hand at the grocery store? In other words, how to help someone not only think, “this Fluff will cost me X hours of work if I buy it.” but also think, “AND I could put the same money in my TFSA and 30 years from now when I’m retired, it’ll be there waiting for me when I really need it.”

Keep up the good work!

Great mental accounting trick! I use the same trick to evaluate large purchases but have never considered it for smaller essentials like groceries. As some one who cooks almost all my meals I think very few pre-made meals are worth it. I will try this out over the next couple weeks to see to evaluate some health pre-made meals! Thanks!

FAST FOOD is it “worth it”?

I just ate at McD’s for the first time in over 6 months and WOW the prices have gone up. Now just a couple of hours later and I am sooo tired. I spent more on a meal than if I made it at home (much more). It didn’t taste as good either. Now I lost my energy. All the empty calories, sugar, etc. drained my system.

SOOOO, this meal cost me more in “earned dollars”, less enjoyment and now energy to “earn more dollars”.

Fast food, is it worth it?

Did you buy the Parka? 😉

I love this method of accounting and have been using it for decades. I also gross up the retail price by my marginal tax rate AFTER retail taxes – this often diverts my wallet away to other horizons…….

As for fast food, I won’t touch it with a barge pole. Non-organic, sugar laden, fat laden, trans-fats, GMOs, then concentrated GMOs in the meat options given GMO animal feed, growth hormones, glyphosates, pesticides, colours, additives, dough conditioners, preservatives…….sure, that will sap anyone’s energy. So there’s the cost to buy fast food and then the higher cost to health, the real total for which is somewhere down the road……..

Hi Lu, No I didn’t buy the parka. I was never in the market for it — I just wanted to check it out. Cheers, Kerry

So, the goose down supposedly comes from farmers. But I don’t think coyotes give their fur willingly. Therefore, regardless of the cost, is not a justifiable purchase.

I think that spending $900 on a coat is beyond crazy. All you are doing is feeding the greed of someone who thought Canadians where stupid enough to do something like that. Everone wearing one if those coats, proved that person was very smart.

Another way to look at it is to compare the cost of something you might “want” to the value of something you’re serious about. I have friends who planned an open-ended world trip. They worked out that it would cost the two of them an average of $100/day for the trip. Everything else became fractions of a day. $50 dinner out – 1/2 a day of travel. Clothes, shoes, etc. – x days of travel. And when they were selling their world just before the trip the money they got was counted in terms of days of travel. Interestingly, their trip cost vastly less per day as they were doing a little work while traveling, and years later they took that travel money and bought a cave home in Spain. 🙂

In my case I think about laptops. I need a good one for my business (I’m a web designer and blogger). So, if a phone costs close to a laptop, there’s no way I’d spend this money, since it doesn’t help me earn money. A jacket would cost me as much as a laptop and, since we don’t have such cold winters here, it’s not something I’d need. Of course, if we talk about a vacation, I’d pay the money without hesitation, since it’s something we care about.

This is an extremely good tip for considering the value of purchases before you make them. I also find that tracking all of my spending in a spreadsheet. The act of having to write down your spending also makes you reconsider as to whether it’s truly necessary.