Use the Couch Potato strategy to build a low-cost and well diversified portfolio, and then download these free tools to rebalance your stock and bond holdings back to the perfect mix.

At the beginning of every month I contribute some saved cash to my Couch Potato and rebalance my mix of stocks, bonds, cash, and other assets. It’s a habit I’ve stuck to over the years to build my savings.

What the heck is a Couch Potato?

No, I’m not stuffing spuds into my Ikea sofa.

Simply, the Couch Potato is an investment strategy that’s keen on keeping costs low by building a diversified portfolio of index funds. Building a Couch Potato portfolio is super simple, and many Nobel laureates have recommended indexing as a way to build wealth.

After learning how actively managed mutual funds charge hidden fees to us investors, sucking our savings dry, I took control of my moolah and moved it into four index funds which essentially return the same results as the world’s stock and bond markets.

“The strategy can reduce a typical investor’s costs by as much as 90%, while at the same time beating the vast majority of mutual funds and professionally managed accounts,” writes Dan Bortolotti in his exceptional blog, Canadian Couch Potato.

The basic components of a Couch Potato portfolio often look a little like this:

Equity index fund 20%

International equity index fund 40%

Bond index fund 40%Asset Allocation = 60% Stocks, 40% Bonds

A mix of 60% stocks and 40% bonds is common in a balanced Couch Potato portfolio, but your asset allocation may be different.

Since Squawkfox is read by Americans, Canadians, Australians, Europeans, and my dog (who is half Australian), I’ll share some international resources for getting your spud on and starting your own Couch Potato.

How to build a Couch Potato Portfolio

The good news is a diversified and low-cost Couch Potato portfolio can be built (and rebalanced) from any sofa in the world. Here’s how to get started:

Resources for Everyone

Two little books with a lot of big value.

- Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School by Andrew Hallam is essential reading for anyone looking to learn more about money, specifically investing. Inside these 180 pages you’ll learn why index investing is amazing, and how to get started from wherever in this world you hail. Read my Millionaire Teacher review here.

- The Little Book of Common Sense Investing by John C. Bogle, founder of The Vanguard Group, is a quick and simple introduction to index investing.

The American Couch Potato

Financial writer Scott Burns started writing about Couch Potato portfolios back in 1987, so there are plenty of American resources available freely online.

- Couch Potato Cookbook: AssetBuilder.com serves up a series of model portfolios created by Scott Burns. Lots of great information on this site to show you the proper potato way.

- The Bogleheads Lazy Portfolios: Created by fans of John Bogle. Site includes a forum, sample portfolios, and a lot of amazing indexing stuff for beginners too!

The Canadian Couch Potato

You know when an American TV show mentions Canada and the whole country of Canuckland cheers in a unified yelp of EH? Gotcha! Canadians like to be noticed, included, and hugged. Well, thanks to financial writer Dan Bortolotti and MoneySense magazine, there’s plenty of Canadian potato resources for Canuck investors to cheer about.

- Canadian Couch Potato FAQ: To get all your loonies lined up, start your learning by reading Dan Bortolotti’s blog, Canadian Couch Potato — voted the #1 investing blog by The Globe and Mail readership.

- Canadian Couch Potato Model Portfolios: Once you’ve learned the potato lingo, it’s time to pick the right funds for your portfolio.

- MoneySense Guide to the Perfect Portfolio: A step-by-step guide to the Couch Potato investing strategy, written by (you guessed it) Mr. Dan Bortolotti.

Yes, I have a school girl’s crush on Dan’s financial writing. Go read him. Seriously.

Rebalance Your Couch Potato Portfolio

Phew! Now back to the real reason I wrote this post — portfolio rebalancing tools. After picking your potato and deciding on an asset allocation, you’ll notice that over time your potato may get a little baked. Turns out the market moves, and sometimes stocks will be smokin’, other days bonds will be boomin’. So basically, you’ll have to bring your potato back in line to your target asset allocation by rebalancing your funds.

Check out Why Rebalance Your Portfolio?, How Often Should You Rebalance?, and The Power of Rebalancing During a Volatile Market for some great background information on, well, rebalancing!

One of the easiest ways to rebalance is to add new money to the funds that need topping up. I do this every month ’cause that’s how often I contribute to my portfolio. You may have a different rebalancing schedule, and that’s OK!

The Problem

The problem is figuring out how much moolah to stick in each fund. All the big finance books say: Make a spreadsheet. Great idea! So I did. I made a Rebalancing Spreadsheet for a few of the popular Couch Potato portfolios in the United States and Canada.

Whether you’re a seasoned investor with an existing Couch Potato or a newbie getting the pieces together, one of these rebalancing spreadsheets should work for you. If your preferred portfolio isn’t included in my humble list, go ahead and edit any of these spreadsheets to work for you.

Download and rebalance away!

American Portfolio Rebalancing Spreadsheets

These model potato portfolios were popularized by Scott Burns and are outlined on AssetBuilder.com. Each portfolio builds on different asset allocations and should be selected based on your risk tolerance. Check out AssetBuilder’s Portfolio Selection to pick the right potato for you.

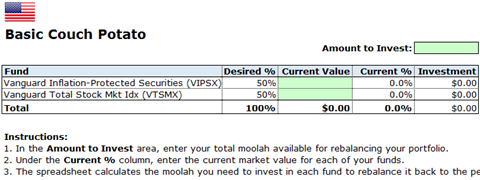

U.S. Basic Couch Potato

A potato with a simple 50/50 mix of U.S. equities and U.S. bonds.

Download: U.S. Basic Couch Potato Rebalancing Spreadsheet (XLS)

| U.S. Bonds | 50% | Vanguard Inflation-Protected Securities (VIPSX) |

| U.S. Equity | 50% | Vanguard Total Stock Mkt Idx (VTSMX) |

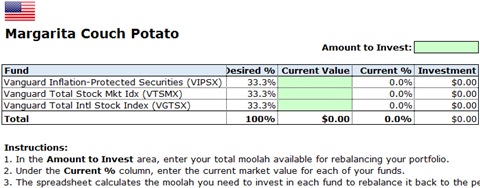

U.S. Margarita Couch Potato

It’s a three-way tie! This model portfolio includes international equities for a little more diversification outside of the United States.

Download: U.S. Margarita Couch Potato Rebalancing Spreadsheet (XLS)

| U.S. Bonds | 33.3% | Vanguard Inflation-Protected Securities (VIPSX) |

| U.S. Equity | 33.3% | Vanguard Total Stock Mkt Idx (VTSMX) |

| Intl Equity | 33.3% | Vanguard Total Intl Stock Index (VGTSX) |

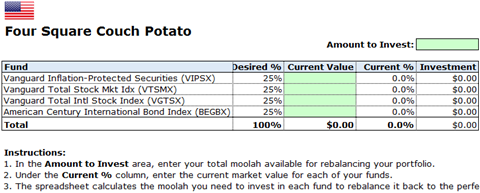

U.S. Four Square Couch Potato

A healthy helping of bonds and equities from around the world and within the United States.

Download: U.S. Four Square Couch Potato Rebalancing Spreadsheet (XLS)

| U.S. Bonds | 25% | Vanguard Inflation-Protected Securities (VIPSX) |

| U.S. Equity | 25% | Vanguard Total Stock Mkt Idx (VTSMX) |

| Intl Equity | 25% | Vanguard Total Intl Stock Index (VGTSX) |

| Intl Bonds | 25% | American Century International Bond (BEGBX) |

Canadian Portfolio Rebalancing Spreadsheets

There are many potato options available to Canadian investors. I have built rebalancing spreadsheets for global portfolios using index funds and exchange traded funds (ETFs). Go ahead and edit these tools if your potato pick isn’t on this menu.

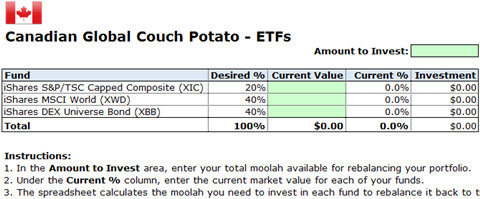

Canadian Global Couch Potato (ETFs)

If you’ve got a big stash of cash to invest then consider investing in ETFs to save on investing fees.

Download: Global Couch Potato Rebalancing Spreadsheet (ETFs) (XLS)

| Canadian Equity | 20% | iShares S&P/TSX Capped Composite (XIC) |

| U.S. and Intl Equity | 40% | iShares MSCI World (XWD) |

| Canadian Bonds | 40% | iShares DEX Universe Bond (XBB) |

Canadian Global Couch Potato (index funds)

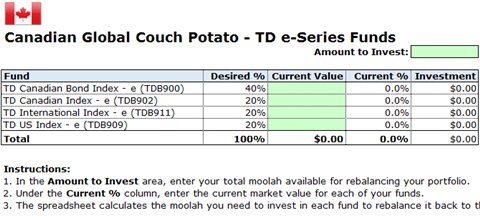

This portfolio is built with TD e-Series Funds, the lowest cost index mutual funds on the Canuck market. I shared my experience with this potato portfolio in the Globe and Mail’s Me and My Money column.

Download: Global Couch Potato Rebalancing Spreadsheet (index funds) (XLS)

| Canadian Equity | 20% | TD Canadian Index – e (TDB900) |

| U.S. Equity | 20% | TD US Index – e (TDB902) |

| International Equity | 20% | TD International Index – e (TDB911) |

| Canadian Bonds | 40% | TD Canadian Bond Index – e (TDB909) |

How to use the Rebalancing Spreadsheet

Every Couch Potato Rebalancing Spreadsheet automatically calculates the money you need to invest in each fund to rebalance it back to the perfect asset allocation — you just need to enter a few numbers.

- Download your Couch Potato Portfolio Rebalancing Spreadsheet.

- In the Amount to Invest area, enter the total moolah available for rebalancing your portfolio.

- Under the Current Value column, enter the current market value for each of your funds.

Smile. Rebalancing your portfolio just got a whole lot easier.

Love,

Kerry

A schoolgirl’s crush? Gawd, I’m blushing. That red potato on the couch is my face. 🙂

Thanks for the mentions, and for a great piece and useful spreadsheet.

I still am doing my homework before I dive into investing, but thanks for the rebalancing info. I’m going to bookmark this for the spreadsheets too!

Vanguard offers index funds with 0.1% fees. TD’s cheapest index fund has a 0.33% MER, up to 0.53% (and even more for their ‘investor series’). Canadians get screwed on MERs whether they’re in trackers or actively managed funds; they just get a bit less screwed by index funds.

[…] Rebalance your Couch Potato Portfolio with these free tools […]

Thanks for the mention Kerry. I’m thrilled that so many people are spreading the word about low cost investing options. Scott Burns is my hero…a brilliant man, superb writer, and a heck of a nice guy who has done a lot for us potatoes.

Scott, you are right, but Canadians don’t have it too bad if we can use TD’s e-Series funds. We could build a couch potato portfolio costing just 0.4% per year….which is half of what Vanguard Australia charges for its funds. Vanguard UK isn’t available directly to investors unless they (the investors) have at least 100,000 (pounds!) per fund and Singapore charges more than double for their index funds compared to what TD charges for the e-Series products. Yes, we have the world’s most expensive funds, but our ETF options are as good as an country’s, and our e-Series funds are far better than most international indexed products. Check out Virgin’s (UK)index funds. Richard Branson created Virgin Money, advertised how great indexes are, and his company charges more than double what the e-Series funds cost–nearly triple, actually. If only TD bank made the e-Series products easier for people to buy. Some hoops to jump through, for sure.

[…] up a lot of points that everyone should be aware of. Squawkfox wrote an article this week on re-balancing your Couch Potato Portfolio with several free tools. If you are using the Couch Potato strategy then you may want to use the free tools listed in the […]

Hey Joe, I must have had Scott Burns on the brain. Sorry about that! My previous comment was a response to your comment. From what I can see, there’s no Scott in the house.

Cheers,

Andrew

Thanks for a great post! I’ll definitely use this spreadsheet.

I am about to purchase my couch potato ETFs for the first time. I would like to make monthly purchases, but I understood I would be charged a commission fee for each trade.

So I was going to rebalance twice per year to save paying those fees on a monthly basis. If you rebalance monthly do you pay monthly trading fees? If not, how do you get around it?

Many thanks,

Tina

lol NP, Andrew. Scott is a good name, although I think “Joe Wood” has more of a ring to it.

It’s fair comment to point out that other countries get screwed worse on index funds than Canada. It’s still a shame that we get screwed four times worse than Americans. 0.4% sounds like nothing, but that 0.3% difference is thousands of dollars for somebody like me who is 40 years from retirement. And that’s the best option in Canada (unless I’m missing something). I’m kind of shocked that ING, which is typically a ‘low cost’ provider, charges over 1% MER on their index funds (http://www.ingdirect.ca/en/mutualfunds/lowcost/index.html)

You’re right Joe, I also chuckled this past winter when visiting my parents in B.C. and receiving the ING information in the mail. They touted index funds in the pamphlet, then offered their “low cost” options exceeding 1 percent annually.

The thing about Vanguard, of course, is that it’s a mutual company, like a non profit. Profits generated don’t go into a business owner’s pockets, but they go back into lowering the expense ratios of their funds. It’s a remarkable company. They have tipped their toes in the Canadian market with ETFs. With luck, they can offer some regular index funds in the near future. Let’s hope they’re cheap.

HSBC, in Britain, offers regular index funds for about 0.25 percent annually. That’s a great deal for regular indexes offered by a profit generating company. It would be great if one of our banks would do the same. They would slay TD’s e-Series funds in the process—especially if the newly created funds were actually easy to buy. TD sure makes investors jump through hoops; they don’t really want people owning the e-Series funds, it seems.

He he he. Cutest pics ever!

Thanks for the information… I’m afraid investing is a little far away for me, but it’s great to learn about these things ahead of time.

I often read about the Couch Potato investment strategy in Moneysense. We may end up moving towards that method as we get older, but right now my husband has far too much fun researching and planning our investment moves.

[…] Teacher: Squawkfox Plugs Millionaire Teacher Again (Canada’s #1 Money […]

The couch potato way makes sense for most investors because of its simplicity. The majority of people just don’t have the time or education to guide their own investments and what they often do is mess things up.

The potato pics are great.

Once more, you’re right: small investors should stick to index funds, end of the story. Stop trying to beat markets, don’t day trade, don’t stock pick, don’t think you’ll do better with active management.

In his book “The intelligent investor”, Graham demonstrates why index funds work over time.

Indexing is simple to understand: there is no trick, no complicated strategy, just follow the composition of the index. If the stock market goes up, you’ll make money. If it goes down, DON’T SELL! The index won’t default, but your ‘hot stock’ can. (A colleague of mine has been cleaned out with a bank in Puerto Rico and Yellow Media).

Buffet said it: make sure you know HOW MUCH it costs to manage your money. So why buy and index fund from a bank with a MER of 1%, when you can buy an ETF from Vanguard with a MER of 0.1% ??? Don’t give away your hard earned money to fund managers. Also, index ETFs are very liquid assets and when markets go down, buy some more.

Nobody ever mentions, but how have the couch potato index funds performed over the past 10 years? It doesn’t seem like anyone’s bragging. I’ve looked at the Canada Trust index funds and can’t seem to figure out where the returns are. Anyone actually made money with their 60% put there?

Why don’t these portfolios ever include Gold or Preferreds or Bond/GIC ladders? I personally work to this goal nowadays:

-Cdn equity: 25% (VCE and CDZ)

-US equity: 15% (VTI and VIG – US currency)

-Int’l equity: 10% (VXUS – US currency)

-Preferreds: 10% (XPF)

-Bonds/GICs: 30% (5 year ladder)

-Gold: 10% (CGL – bullion ETF)

Seven ETFs and a ladder of fixed income investments (rather than a bond fund at this stage in the cycle). Rebalance yearly (thanks for the spreadsheet). And I try to be tax efficient between my TFSA, RRSP and non-registered investments. Not so hard and I sleep well.

Thanks for posting those useful spreadsheets.

Comment on this one:

Canadian Global Couch Potato – TD e-Series Funds

1. the symbols for the funds don’t match fund names, the right mapping should be:

TD Canadian Index – e (TDB900)

TD US Index – e (TDB902)

TD Canadian Bond Index – e (TDB909)

TD International Index – e (TDB911)

2. also it’s easier to use if fund is listed in following order:

TDB900

TDB902

TDB909

TDB911

Which is how it’s done when holdings is downloaded from TDW into .csv file, then user can simple copy and paste the market values into your spreadsheet.

Just a comment on those ING funds,they are re branded AGF funds,the MER is not the only fees. You will have to dig into the paper work to find the extra fees ,but it’s there.

Jay, I can’t find that info. I did see that ING sold their old funds to AGF in 2005. But they created brand new ones in 2008 and those are what they are selling today.

Mr. CDN. Couch Potato,

I wish I had found your blog earlier!(Last year, when I opened a Questrade account, and wasted money in commissions – most from selling out of fear)

But, live and learn.

Thank you for posting such useful information for those of us that need insightful guidance for our DIY investments.

I discovered your website by accident, because I have been researching ETF options to supplement the stocks I am now holding on to.

Your well-documented facts, feedback, and Portfolio examples have helped me to rethink my RRSP investments.

I will continue to read and value your useful articles, because it is empowering to take my finances into my own hands.

Cheers,

MyFairShare (Deanna)

I was teased with the mention of international readers and specifically European (like me), but then your couch profiles are only US/Canadian.

Do you have any resources for beginning couch potatoes in Europe?

Thanks for the useful spreadsheet. I was looking for something like this for my couch potato portfolio. I did make my own but it is a bit cumbersome. Your spreadsheet is much refined…lol…Thanks Again.

Do you have couch potato information for UK?

I realize I’m verrry late into this conversation, but could you give more info re: which discount brokerage you use, how often you rebalance your ETFs, whether you’re still recommending the ETFs given on the spreadsheet? Do you use both the e- series and the ETFs? Thanks for any help you can give with this!

Love the spreadsheets! If I follow the Canadian Global Potato spreadsheet, should I keep the proportion the same if I put my investments in a TFSA and in a non-TFSA account? Or how can I change it to make it more tax-efficient? Thanks!

I first read this article in 2012 and invested in the e-Series funds with a 40% fixed income, 60% equity in a TD self directed LIRA (I had no choice but to put it into a LIRA since it was from a former employer’s pension plan that I wanted to self-direct myself). The MER’s I was paying at the former institution was crazy.

Today, after 8 years my personal rate of return is 103.02% and an annualized rate of return of 8.57%. Considering I did absolutely nothing during those 8 years I’m happy with the results. I mean, I’m not an expert but I ‘think’ these are decent returns correct?

One note worth mentioning is that I should have rebalanced the portfolio but left it heavy on the US Equity side.

The funds have recently changed in the last year I believe to include ETF holdings instead but essentially the same.

Anyway, wanted to thanks for the spreadsheet and great article on the eSeries.

I am increasingly interested in the ‘All-in-one’ ETFs that are coming online lately that do all of this for you, exciting time to be a retail investor thats for sure!