Goals — we all have them, right? Sometimes we quietly keep our financial goals to ourselves, other times we hashtag the aspirational feats of others as #goals across social media.

I want you ignore social, forget about FOMO, and focus on yourself, OK? I want you to set your own money goals without comparing yourself to others, and then slay them on YOUR terms. The social hashtag announcement-thing after hitting your #goals is totally up to you. 🙂

[Related: How social media and FOMO wire you to spend money]

Financial goals can address your immediate needs, your long term dreams, and everything in between. Perhaps your goal is to start an emergency fund so you’re not constantly stressed about work, maybe you want to pay down student debt, or maybe you’re looking ahead with the goal of saving for your first home. Oh heck, maybe you just want a vacation. These are YOUR goals, so no judgement here. They’re up to YOU.

Whether your goals are short-term or require a longer term commitment, everything is possible when you identify your personal financial goals and develop a plan to reach them. Go #goals.

Setting financial goals throughout your lifetime (and adjusting them) is also an important part of financial planning. What’s the saying? — “A goal without a plan is just a wish.” Well, no wishy-washy here!

Goal setting works, and I’ve lived the reality. When I paid off my $17,000 student loan it wasn’t because of luck — it was because I had an actionable plan with achievable steps set to a timeline. Paying down my student debt had everything to do with setting the goal (slay my student loan), having the motivation to follow the debt reduction plan with actionable steps, and knowing the end was near ‘cause I wrote “STUDENT DEBT FREE DAY” on my calendar. Boom.

To show you this isn’t just wishful thinking, I’ve put together TWO Financial Goals Worksheets to help you identify your short term financial goals, set your long term goals, and achieve results through planning and goal tracking.

Here is my five-step process for slaying your #moneygoals:

Step 1: Get Inspired & SMART

Whether you’re building savings or reducing debt, your #goals should follow the SMART rule of thumb to succeed. SMART stands for: S-specific. M-measurable, motivational. A- achievable, action-oriented. R-realistic, rewarding. T-time-based, trackable.

Short term financial goals can fund immediate needs for today, increase cash reserves for next month, or build savings for a year from now. Longer term financial goals may take three years or longer to hit. Perhaps you’re saving for home down payment, aiming to pay off student debt, or starting a retirement savings plan. With specific longer term goals in mind you’re more likely to watch your cash in the shorter term and make better money decisions.

Here’s how to identify and nail down a short-term goal using SMART.

GOOD: I’d like to get rid of my credit card debt.

BETTER I’d like to pay off my $3,000 credit card this year.

BEST: I will pay off my $3,000 credit card balance by May, 15, 2019.

[Related: What Order Should I Pay Off My Credit Cards?]

This is a SMART #goal because it’s specific, measurable, achievable, and time-based. You may only get to the BETTER step at this point, ‘cause knowing timelines and money available for saving/debt repayment is another step. So list your short term AND long term goals and rework them as we move along.

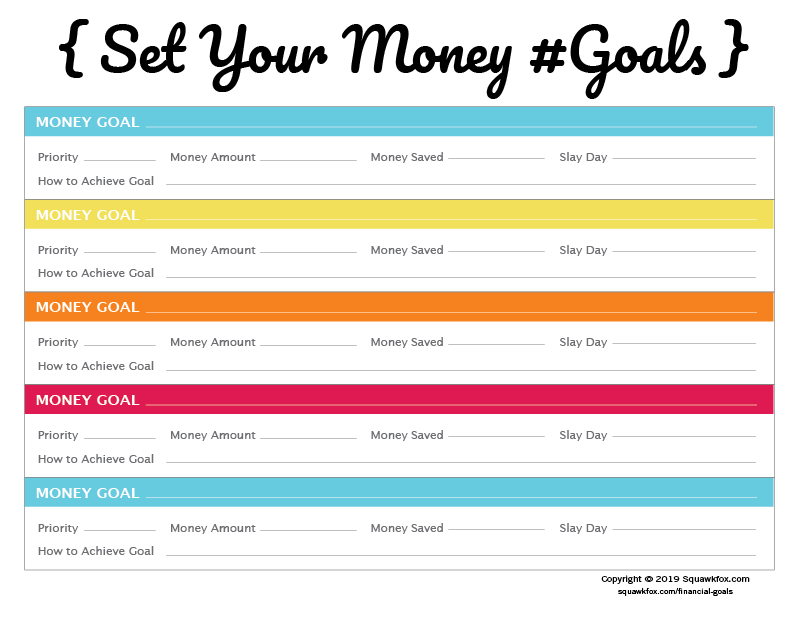

Download: Set Your Money Goals Worksheet

Use the money #goals worksheet, like:

- List your short term (ST) and long term (LT) goals.

- Prioritize each. Rank each ST and LT goal.

- Pick a tentative target date.

- Give each goal an estimated dollar amount.

- Account for money already saved for each goal. Zero is OK!

This isn’t a super tricky task, it just takes some honest thinking to make each goal attainable and reachable. Maybe you need to cut back on something (dining out) or take an extra shift (bummer, I know) to fully fund your priority short term goals — but that’s totally up to you!

Step 2: Reality Check Your Financial Goals

How much money do you REALLY have available each month to meet your priority short term and long term goals? Dunno? No worries, but it’s a good idea to reality check your money situation so you don’t set yourself up for #goal failure at the outset. I want you to succeed, so let’s get to it!

Get the Money Tools

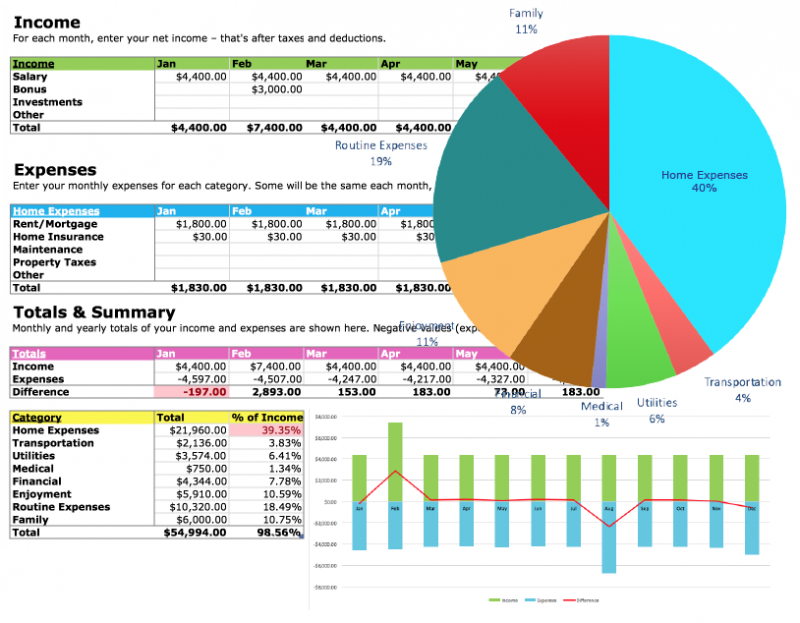

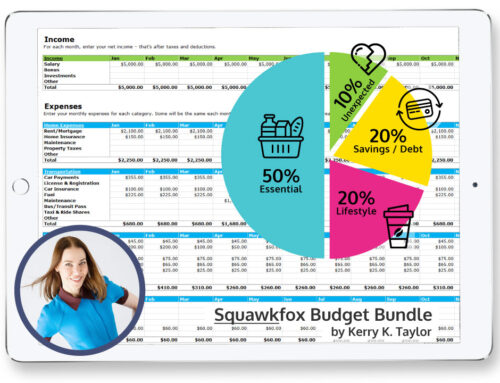

The Budget Bundle: Grab my free budget spreadsheet to see how your income and expenses add up. How much wiggle room do you have for your money goals? Figure out how much money you can set aside each paycheck.

Download: Budget Spreadsheet

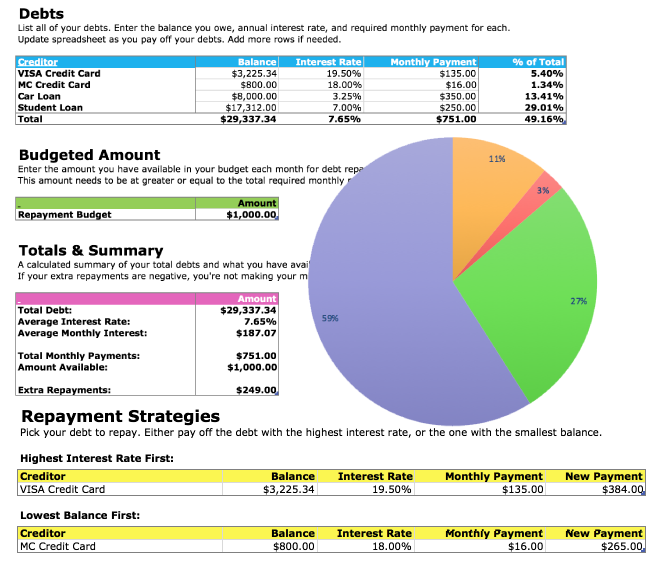

The Debt Destroyer: If your goal is to get outta debt, get my free debt reduction spreadsheet to better visualize and account for the monthly repayments needed and to figure out how long it will take.

Download: Debt Reduction Spreadsheet

Now take a deep breath. You can do this!

Step 3: Do the Math

With your priority goals in focus and your reality check in place, here’s a strategy for figuring out how much time you’ll need to hit your target financial goals.

First, estimate the overall cost for a goal. Second, divide that amount by the total number of months to reach the goal.

GOAL COST / NUMBER OF MONTHS = $$$ TO SAVE PER MONTH

For example, let’s say your short-term goal is to pay off a $3,000 credit card balance in four months. Bottom line is you’ll need around $750 per month to fund this goal ($3,000 / 4 months = $750 per month, plus interest).

[Related: Are you paying just the minimum balance on your credit card?]

If your monthly number fails to make sense given your reality-checked budget, aim for a longer time period (maybe another month) to get outta debt. Whether you’re saving for a home down payment or aiming to reduce debt, don’t get discouraged if slaying your goals takes a bit longer to achieve than you hoped — having some money banked with a realistic timeline is going to feel amazing.

Step 4: Use Brain Science To Fund Your #Goals

We need to remove the pressure, anxiety, and brain energy needed to put money aside each month. The mental work needed to move money around and to fund each goal, every month can be exhausting. I know, because I’ve been there.

You are far more likely to slay your money goals and not impulsively spend your savings if you open a series of savings accounts — each specific to your savings goals — and then automatically move your money each month using your bank’s auto transfer tools.

If your bank offers a no-fee high interest savings account with no minimums required, then open an account for each goal. For example, open accounts for: HOME (your home down payment account), TRAVEL (your vacation savings account), EMERGENCY FUND (your ass-saving money account), etc. For longer term goals like retirement, go ahead and open an RRSP or TFSA (Canada) or 401K (America) to funnel your money into.

Making the decision to save ONCE and setting the money to transfer automatically is a lot less emotional than trying to resist the urge to splurge when your income rolls in.

Creating accounts tied to a specific savings goal is scientifically proven to work. Behavioral Economists call this phenomenon or bias, Mental Accounting — our tendency to treat money differently based on the source or the intent.

For example, due to mental accounting we’ll treat windfall money differently by spending it on impulse purchases but tend act more conservatively with our paycheck income.

By creating a physical account and an intention to fund each financial goal, you’ll also nudge yourself to mentally account for your savings goals and succeed. Yay, brain science!

Step 5: SLAY Your Financial Goals

Now that you’ve decided upon and adjusted financial goals, opened the accounts to hold the money, and set your savings or debt repayments to automatic, it’s time to track of your progress over time.

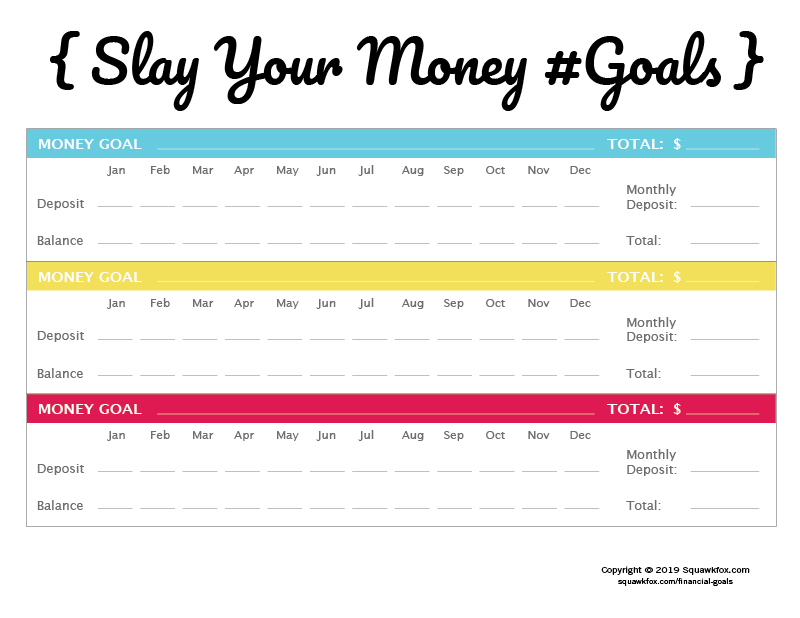

For this you’ll need to download the Slaying Goals Worksheet and mark off each milestone as you reach it!

Download: Slay Your Money Goals Worksheet

How to do it:

- Write out each goal

- At the end of each month, tally up and track your progress.

- Post in a visible place so you can track your progress.

You may just feel inspired by how fast these little drips of money can add up over time and help you reach your money goals sooner!

Love love love,

Kerry

I like this series a lot! One piece of input I might offer is that, if a whole month is too long a time period – that is, if you’re the sort of person (like me) who needs IMMEDIATE success – you might break the year down into pay periods (biweekly) or weeks, so you can save more regularly and monitor your progress more often. Or maybe I’m alone on that…

[…] How to Set Financial Goals – 3 Financial Goals Worksheets | Squawkfox […]

These are great Kerry; especially No3. Thank you 🙂

These are nice! I would love them *even more* if they were fillable, though, so I could type in my goals; any chance? 🙂

It’s nice! i have never had financial planing goal before. but, with the sheet, i think it will be not too complicated.

thanks

These goal sheets are pretty neat.

I find what works for me is a goal setting app called GoalsOnTrack and it has worked very well. It saves me a lot of time in keeping track of my goals and most importantly it helps me better organize my daily todos towards achieving my goals. You may want to check it out.

[…] presents How to Set Financial Goals – 3 Financial Goals Worksheets. You can always count on Kerry to create a worksheet to help you get better organized. Despite how […]

Hello, I was just wondering what about if you live check to check like me??? As of last year I have dedicated myself to paying off my debts and i have, I am presently in the process of even changing cellular phone plans to save $ on the monthly bills and switched to a cheaper cable/dsl plan to save even more $$$, however, this is my deal I have ONLY two credit cards with only a $600 limit, and paying off an old debt which I owe $428 so I am close paying that off. I have done my numbers my monthly bills (utilities, and credit cards) add upto $239, now my take home is pretty good, however, my mortgage is at an adjustable rate of 6.5% and I owe $158000 on my home and $89000 in student loans, which the payments are at$820/month!!! Those are my two highest bills, how can I pay them off quickly?? What can I do to lower the monthly payments? Now my credit is not that bad but it ain’t that good, but it has increased since I have been paying off just about all my debt, just this month I saved $800 but that was due to overtime which is not guaranteed. And when I do get it, I save that extra money I dont consider it part of my paycheck, I tell myself don’t count that extra money as part of your regular check, so I put it away. But I would really love to know how pay off the mortgage and student loans??? What can I do please help.

Thank you.

Lao R.

Thanks so much for these worksheets! I was looking for a way to keep my goals in front of me and have a way to keep track easily. Thanks again!

This definitely helped me. As a high schooler, learning an easier way to get through financial planning is very pleasing. 🙂

I use “Smarty Pig” for my goals. I have each goal set up with the date I need the money (such as the month when all my insurance policies come due) and have smarty pig draft my checking account so that the month before they are all due, I have the money. Smarty Pig is currently paying 1% interest posted quarterly. I also have one goal account that I notify the pig to draft whenever I have a ‘extra’ money – it’s my ‘just in case’ account.

Kerry, Good reading..

I am also big fan of Excel sheet to track my daily, monthly and yearly expense as well as case flow.

One numbers are set, its easy to chase the objective. Be it wealth build up or keep expenses under control.

Keep up the good work! 🙂

Hi. Just wanted to let you know…. about 11 years ago I gave up my cable subscription. This gave me $600.00 to spend on other things. i.e. season packs of DVD (on sale) and I have never gone over the $600.00 per year. My gross savings over the period is approximately $6,600.00 (based on 2003 cable costs) probably much more as cable costs have increased. I have all of the shows that I enjoy to watch…on my terms, any time, day or night. My news feeds are from Google News, as is the weather and sports.

Five months ago I cancelled my telephone account and installed an IP telephone. The cost for this was $49.95 for the unit, $10.00 for a Canadian number and a yearly cost for the service of $30.00. This gives me a saving of about $700.00 per year over the BIG carrier. I have not had any issues with the service to date. Also I have FREE long distance in North America, call display, touch tone, voice mail, call forwarding and conference calling…..all included in the $30.00. The only thing I will not skimp on, is my Internet connection. My telephone savings alone covers the Internet cost.

My estimated yearly savings at todays rates, for the cable and the telephone….probably $1,800.00 per year.

I would like to get the achieving goals spreadsheet in an Excel file instead of a pdf file. Thanks

hi Kerry

Is there anything new you can add for 2016?

Outstanding post, I especially like how you place exclamation on focus and determination. Setting realistic goals within an acceptable time period is crucial to achieving financial goals. Nothing really worthwhile will ever happen fast, it takes time to build a castle.

Definitely agree with posting it in a visible place. You are more likely to accomplish the goal if you keep it before you. I can personally attest to this.

[…] well known in the industry; the way she talks about money is infectious and galvanizing. Check out this post about setting money goals using the SMART method (Specific, Measurable, Achievable, Realistic and […]

This is the year that I’m getting more serious about our finances, mostly cutting back on thrift store spending! I love finding great deals at thrift stores, but I also know that sometimes I find things I don’t need! Then they end up back at the thrift store!

Thnks for an excellent template