🚨 Beware

It’s fraud prevention month. Financial fraud, scams, and shills – be aware because they are everywhere. On the surface it may seem easy to spot dubious “opportunities” and schemes, but in reality it’s not.

- Scammers are stealthy and sly, and countless well-intentioned and smart people fall victim to them daily.

Since I cannot protect everyone from financial fraud (I wish I could) I’m going to help in the best way possible – by sharing with you guys how to recognize the signs.

- I asked many financial professionals what scams are all too frequent. I’ve got five to cover.

(🇨🇦 Hey Canucks, I sent a special newsletter last week on choosing between TFSAs and RRSPs. Give it a go if you missed it ’cause it’s insanely popular.)

Let’s do this!

Today’s newsletter is 1,153 words, 5:45 minutes.

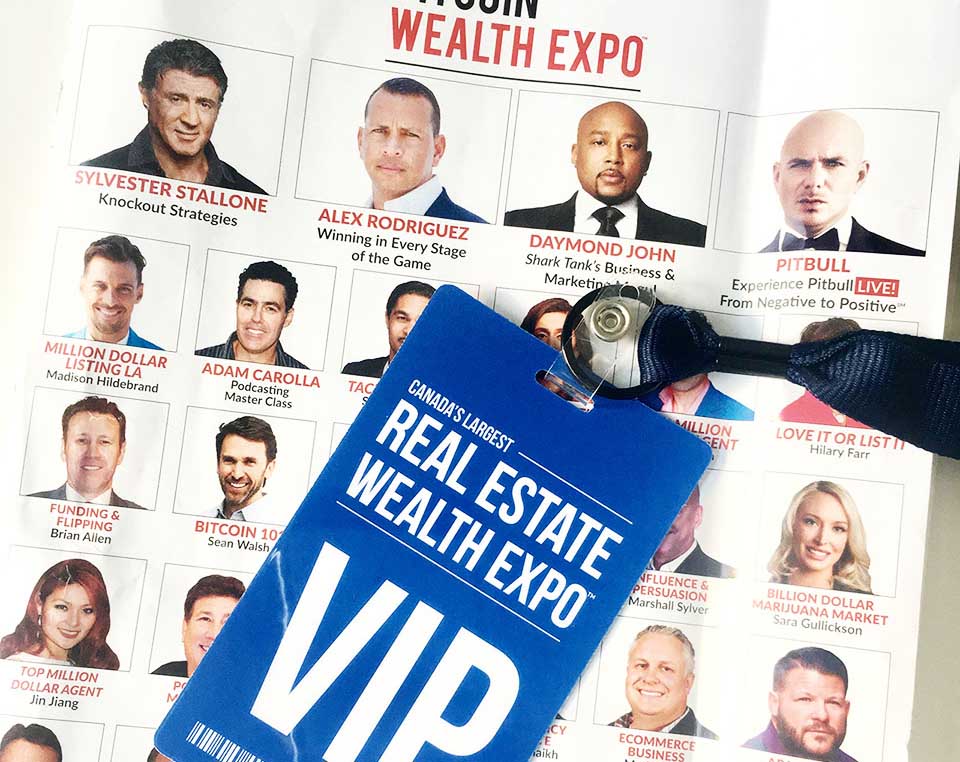

1. The Bitcoin Real Estate and Wealth Expo

🍿 Eventful. The Toronto Wealth Expo was something I’ll never forget. It was like a circus, but instead of lions, tigers, and bears there was endless bitcoin, real estate, and cannabis “opportunities”. Oh my!

🏠 Under a single roof. Celebrities boasting about “living only once” and to “go for it”, a hypnotist selling skills to read the market, a guy pitching a software trading platform, housing dudes selling land in Florida, and a bunch of speakers hyping up bitcoin investing. I lost track.

⭐ Celebrities. The highlight was Sylvester Stallone talking about the risks he’s taken in his life. Pitbull gave a mini concert which was interesting ’cause he sang his hit, From Negative to Positive, which was pretty much the opposite of what was going on. And Alex Rodriguez gave snappy Shark Tank advice.

- The whole thing was seductive, entertaining, and mostly believable. Who doesn’t like celebrity sightings?

🤯 Shocked. In complete bewilderment I live-tweeted the 8 hour event and the thread went viral. The pitches seemed funny outside of the expo, but inside, people bought the courses and signed up for the investments.

- I wanted to scream “DON’T DO IT” but I’m sure I would’ve been arrested. There were security guards everywhere.

Here’s the full story: I went to a Bitcoin Real Estate Wealth Expo so you don’t have to

- It’s funny, yes. It also serves as a dire warning.

🚨 Protect yourself: The signs were everywhere but it’s hard to see clearly inside events like these. Here’s what I found:

- Rags to riches. EVERY speaker talked about having no money, then striking it rich. Motivation, tenacity, hunger, and putting “skin in the game” made the difference.

- You are family. Financial hustlers want you to feel like you belong.

- Easy street. There’s no effort, just put money down.

- FOMO. Don’t miss out. “Sale ends in 10 minutes.” Pressure cooker.

- Trust them. Forgo your due diligence, ’cause “It’s easy”. They are telling you “everything you need to know.”

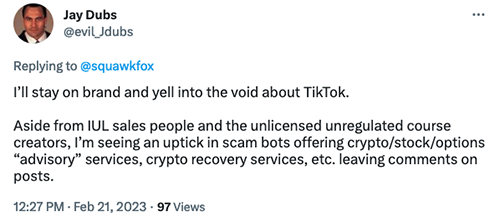

2. TikTok Finfluencers

💸 Financial influencers. They’re across all social media platforms but TikTok is ground zero for financial influencers selling courses and partnering with financial firms to sell stuff. The audience is mostly Gen Z.

- The catch? Well, there’s always a dubious catch when non-credentialed people sell suspect stuff on a platform without any liability.

🚨 Protect yourself: This may seem simple, but don’t take financial advice from people on social media, especially if they’re trying to sell you stuff. If they’re pumping bitcoin, meme stocks, or insurance please unfollow and run.

- Fininfluencers seemingly just talkin’ about money are also warn-worthy – it’s not uncommon they get the facts twisted. Not being held accountable to anyone is just another red flag.

- If you’re a Gen Z (or you love one), please please please find credible sources for financial content ’cause while TikTok may seem fun and harmless, the platform will not protect you from fraud.

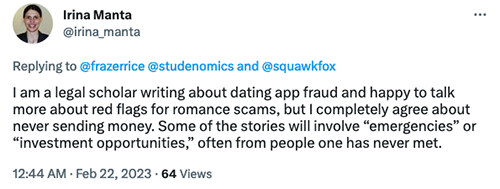

3. Dating App and Romance Fraud

❤️ Love, true love? Let’s say you meet someone who seems amazing on a dating app or website. Sparks are flyin’ and phones are a ringin’.

- They say it’s true love and fate you met, especially ’cause you live far away.

- Out of nowhere they ask for money for an emergency, something urgent, or a plane ticket to see you.

💔 It could be a romance scam. These fraudsters create fake dating profiles and contact you via apps and social media. Once they build trust through love bombing and daily chats, they drop a heart breaking story for your money.

👉 When I asked about online fraud, both blogger Martin Dasko and legal scholar Irina Manta shared their advice on dating app scams.

- Irina hosts the Strangers on the Internet podcast where she and her cohost, psychologist Michelle Lange, help you navigate complex relationships and avoid predators and narcissists. They’ve got the research to “make online dating work for you”.

🚨 Protect yourself: Red flags are waving when your new love interest can’t meet you in person, asks for money, and tells you how to pay. Stop communicating, block the account, and run.

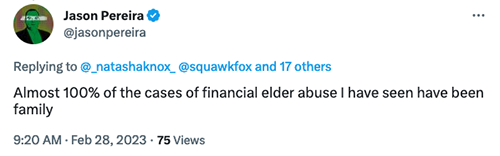

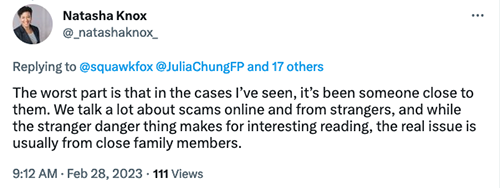

4. Guardian Scams and Elder Abuse

Financial abuse of the elderly is on the rise with our aging population. It’s too common and it’s often hard to recognize until a vulnerable person has suffered a significant financial loss.

🚨 Protect a loved one: Investor Rights Advocate FAIR Canada offers ways to protect vulnerable investors from financial abuse. These include naming a trusted contact person at their financial institution and putting temporary holds on large or suspicious transactions.

5. The Grandparent Scam

Impersonating a grandchild is how many scam artists exploit seniors. The scam goes like this: The victim gets a dramatic call from someone posing as their grandchild and pleading for financial help due to an accident, robbery, or getting stuck in a foreign country.

- Using social media content from their family members, the scammer is able to drop familiar names to appear legitimate to their victim.

🚨 Protect a loved one: The AARP lists numerous tell-tale signs and ways to protect yourself – their top level advice is to set privacy settings on your social media accounts so only the people you know can access your content.

If you think you’ve been a victim of financial fraud please contact your local police department as well as your regional fraud center:

Feel free to forward this message to the people you love and care about. Helping and protecting others is everything. And a big thank you to all the financial experts who contributed to this newsletter – you guys are amazing.

Love love love,

Kerry