🇨🇦 Which to choose?

March 1, 2023 is the Registered Retirement Savings Plan (RRSPs) contribution deadline for the 2022 tax year. Knowing your income, tax bracket, and carry-forward room can help you decide whether to make a last-minute contribution or not.

Should you sneak in an RRSP lump sum before the deadline? Which gives you more bang for your buck – an RRSP or TFSA? If you’re new to this stuff I’m here for you.

Today we’re talking about two Canadian investment vehicles. Both are awesome. The finer details are beyond the scope of a newsletter, so I’m sticking to higher-level stuff.

Let’s do this!

Today’s newsletter is 1297 words, 6½ minutes.

1 big thing: RRSP vs TFSA

Mirrors. Both accounts are fantastic. They are mirror images of each other.

- An RRSP is where you contribute pre-tax dollars to reduce taxable income.

- A TFSA is where you contribute after-tax dollars.

Containers. Think of your RRSP and TFSA as containers for growing tax-sheltered savings. Each can hold a variety of investments – for example: GICs, High Interest Savings Accounts (HISAs), exchange-traded funds (ETFs), index funds, stocks, bonds. Excellent.

🍎 Is an RRSP right for you? An RRSP is a solid option for anyone looking to grow their wealth without immediately paying taxes on earnings.

- It’s a tax-deferred account, so you won’t pay taxes until you withdraw.

- Higher income earners will get the most tax relief, especially if their income in retirement is lower.

- Younger peeps just starting out can also benefit if they get an employer match. Yes, get the match. Again, get the match.

🍏 Is a TFSA right for you? A TFSA is a flexible option for anyone to grow savings without paying taxes, ever.

- Every after-tax dollar you contribute to your TFSA not only grows tax-free, but you withdraw it tax-free.

- All income levels can benefit from tax-free growth.

- Many younger peeps with modest incomes can use a TFSA for retirement savings.

🔥 High Level Bottom Line: Your tax bracket can influence your decision.

- RRSPs are great for higher income earners seeking tax relief.

- Generally, those earning under $50,000 per year could prioritize TFSA savings – withdrawals won’t trigger clawbacks on retirement subsidies.

- Those with a defined benefit pension may not need to contribute to an RRSP ’cause the DB plan guarantees retirement income. If you’ve got one, congrats.

Both plans have advantages and disadvantages, so let’s break it down.

2. Your RRSP

🍎 An RRSP is where you contribute pre-tax dollars to reduce taxable income.

💰 Wanna pay less income tax? Yes! An RRSP contribution allows you to deduct that amount from your taxable income. Depending on your tax bracket, you may get a tax refund.

- Deadline for contributing is March 1, 2023.

- An RRSP is not a tax-free dealio. Yes, your investments grow tax-sheltered inside the plan, but you’ll get taxed at your marginal tax rate when you withdraw for retirement.

🎯 RRSP Goals: The goal is to contribute in a higher tax bracket when you’re working, and withdraw in a lower tax bracket in retirement, thus paying fewer tax dollars over your lifetime. Goals.

☀️ How much? The RRSP contribution limit for the 2022 taxation year is 18% of earned income you reported on your tax return in the previous year, up to a maximum of $29,210, plus any carry-forward room. Phew.

- Check CRA My Account for your contribution limit.

🥳 Your age. There’s no minimum age to contribute – you just need to have an income and file a tax return. So a kid YouTube star (they exist) earning millions will have taxable income and can contribute.

- I had a paper route in my early teens and filed a tax return to start building my RRSP carry-forward room. While I didn’t start contributing until I was older, I had space to score a larger tax refund later.

- The year you turn 71 is the last year you can contribute. There are rules.

💸 Making withdrawals. You generally have to pay tax when you cash out, make withdrawals, or receive payments from the plan.

- Withdrawals are included as income when you file taxes.

- Early withdrawals from RRSPs may result in you losing contribution room. However, withdrawals can be made from your RRSP for the Home Buyers’ Plan or through the Lifelong Learning Plan. Both must be repaid to avoid taxes.

🎉 Your tax refund. It’s tempting to spend a tax refund, a work bonus, or a birthday gift. But don’t. Your TFSA is the PERFECT place to grow your savings, especially your tax refund. If you get a refund from contributing to your RRSP, invest it back into your RRSP or stick it in your TFSA. You’ll thank me in the future. Promise.

😟 Feeling pressed? You don’t need to rush into an investment decision right away. You can park cash (maybe in a HISA) in your RRSP as a makeshift measure to meet the deadline and get your tax refund, and then decide on investments later.

- Don’t let your cash languish though – be sure to invest based on your time horizon and risk tolerance.

⚙️ Automate it next year. Finding the cash to stash in your RRSP before the deadline can be stressful, so set up automatic contributions moving forward. Not only is it easier to budget evenly, but you’ll take advantage of dollar-cost averaging across market fluctuations.

3. Your TFSA

🍏 A TFSA is where you contribute after-tax dollars.

💰 Wanna grow your savings tax-free, forever? Yes! Every after-tax dollar you contribute to your TFSA not only grows tax-free, but you withdraw it tax-free. No tax. It’s all yours to keep. There isn’t a hard deadline for contributing.

🎯 TFSA Goals. The goal is flexibility. You can save for the short term. Long term. For retirement. For a holiday. Do what you like.

😡 Terrible name. The TFSA is an amazing account with a stupid name. It should be called the TOTALLY FANTASTIC INVESTING ACCOUNT. Sorry for yelling. By calling it a “savings account” too many Canadians use their TFSA just for parking cash in GICs or HISAs for short term savings. (screams)

- The real power of the TFSA is investing for the long term. By using your TFSA as a long-term investment account and not a short term cash savings account, you’ll maximize tax-free growth and compound interest. I use mine for retirement savings.

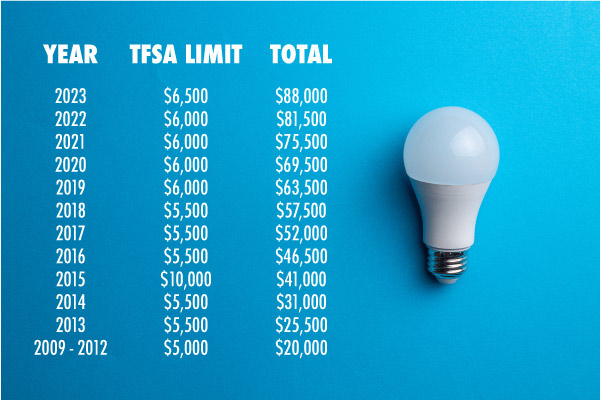

☀️ How much? Your contribution limit increases every January 1st. The limit for 2023 is $6,500, plus any carry-forward room.

- Can’t contribute this year or haven’t opened an account? No worries.Your TFSA room is cumulative.

- Check CRA My Account for your contribution limit.

🥳 Your age. You’ve gotta be 18 (or the age of majority in your province) to contribute. You don’t need an income to contribute, however you should file a tax return annually to establish a record of your TFSA contribution room.

- ‘Cause contribution room is cumulative, anyone who was 18 or older in 2009 has up to $88,000 total room in 2023. See the chart for more.

- There’s no upper age limit for contributing.

💸 Making or replacing withdrawals. You can generally withdraw any amount from the TFSA at any time. You won’t pay taxes. Withdrawing funds from your TFSA does not reduce the total amount of contribution room. But there are rules for replacing funds and penalties for messing up.

💪 You’ve made it to the end. Happy RRSP season. You are awesome.

Love love love,

Kerry