How to Find Your Net Worth is part of a financial planning series called How to Make a Budget — Easy Steps for Beginners.

I’m worth it. You’re worth it. We’re all worth it. Great. I love it when advertisers sing me the tales of “worth” to make a sale. The pitch must be working because everyone these days is praised for being “worth it”.

But are you worth it? The sad scenario is many of us have no clue what we’re worth. We amass assets, incur debts, and still have no idea how the mathy math adds up.

I want you to know how the math adds up.

What is individual net worth? Your individual net worth number is a vital financial planning tool. It serves as a barometer for your personal financial health and helps you establish a baseline to measure your progress towards your financial goals, including: paying off debt, buying a home, saving for retirement, planning a wedding, traveling, or whatever!

What is household net worth? Your household net worth is the accounting of both you and your partner’s assets. Partners may often calculate their individual net worth first to see how each of their retirement plans are doing, then add the results together to calculate their household net worth to complete the financial planning picture.

Finding either your individual net worth or your household net worth sounds scary, but really it’s just this simple calculation:

Financial Assets – Financial Liabilities = Net Worth

What You Own – What You Owe = Net Worth

Calculating net worth is all your financial assets (what you own) minus all your financial liabilities (what you owe). If your net worth is a positive number, then you own more than you owe. If your net worth is in negative territory, then you have debt.

When crunching your money-math, it’s important not to confuse your net worth with your self worth. Don’t let a negative net worth give you a case of the “sads”. Having debt doesn’t make you a bad person, and having a million dollars doesn’t make you Mr. Wonderful either.

This may sound strange, but your net worth number is not the most important factor in doing this exercise. Surprised? What is important is how your net worth changes over time and the direction it’s going. The idea is to move your net worth into positive territory, and increase it over time.

In order to gauge the direction your net worth is headed, you need to calculate it regularly, and objectively chart your progress.

Add up your assets

There are numerous ways to chart your assets, and not everyone agrees on the right approach. Since I’m a Flexible Fox, I’ll give you a few options to consider. The idea is to pick your method and stay consistent.

Tally your financial assets. A financial asset can be cash in the bank today, or an investment you plan to cash out in the future. So if you’ve got cash in the bank, stocks, bonds, retirement accounts, CDs or GICs, government benefits, pension payments, mutual funds, exchange-traded funds, or cash stuffed in your mattress then you’ve got financial assets. Yay!

Is your home a financial asset? There is debate as to whether you should include your home as a financial asset in your net worth calculation. This argument may be emotionally based for some and logically solved by others.

Those for adding a primary residence to your net worth believe a home is your biggest financial asset, representing one of your largest single investments. Yes, homes are expensive.

Those against including a primary residence argue that selling your home can certainly give you cash, but what if it sells for less than you paid for it? Also, selling your home kind of makes you homeless. Since we all need shelter, you’ll probably use the money from the sale to buy another place to live.

If you’ve just painted the living room and installed a new kitchen, you may be miffed by the idea of not including your home as an asset. No worries. There’s a way to bridge the gap. Some financial types suggest you only include your home if you expect to sell it and live off the cash, or if you plan to downsize to a less expensive property and use that equity to fuel your lifestyle. If this is your plan, then add this equity as an asset.

What about your personal property and car? I hate to break it to you, but your designer jeans and Jimmy Choo shoes are not financial assets. Sure, they may be an asset to your arse, but generally speaking, your personal property is not a financial asset. However — and this is a big however — if you plan to sell your Choos for cash in the near future, then kick up your heels and include them in your net worth.

Cars are another gray area. If you add your fine automobile as an asset, then be sure to account for depreciation when you next update your net worth statement.

Those who have used my 15 Free Printable Home Inventory Worksheets have a leg up when tallying personal assets. Having your stuff listed in a personal inventory can serve as valuable tool for planning your estate and establishing a record for insurance purposes.

Subtract your liabilities

Don’t roll your eyeballs in my direction. The majority of us have some loans and debts we need to account for. If you’ve got credit card debt, car loans, student loans, or money borrowed from friends and family, then it’s time to face the facts and tally up what you owe. Don’t forget to add the mortgage on your primary residence as a liability if you included your home equity as an asset.

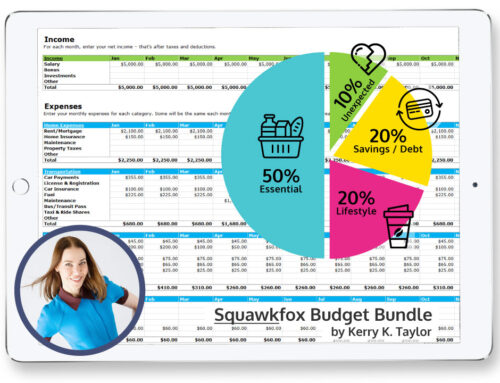

Now take some time and find the paperwork for all your financial assets and liabilities. The next article will include some budgeting tools to help you account for these numbers. Yes, I’ll be posting a Net Worth Spreadsheet to help you along the way. But you need to find your paperwork first. 🙂

Get the series, How to Make a Budget – Easy Steps for Beginners, for more free tips, tools, and free downloads.

Love love love,

Kerry

The calculation gets even easier when you eliminate your debts. The equation then becomes Assets = Net Worth as your debt is zero. Thanks for the article, it is good to be aware of where you actually balance out.

@BibleDebt HA! I think that’s the best simplification ever! Love your thinking. 😉

I calculate my net worth each month, I use NetworthIQ.com to keep track. I do add the cars in my net worth calculations, but I undervalue them. I figure if everything goes sideways I can always sell at least one of my cars, so it’s an asset in my mind if I can sell if for cash. Household good, not so much.

Have you read Robert Kiyosaki’s books? He has some interesting concepts about assets and investments which may go against the common accounting definitions of such terms.

If you are going to include assets like cars when calculating your net worth, they should probably be entered at their market value (what you could sell them for today) rather than at their book value (what you paid for them) or their replacement value. Standard accounting practice in business is to use the book value but that doesn’t tell you much when you’re a person considering your net worth.