Stu is a smart guy, he asked me for an “Expense Tracker”. He sent me a super nice email asking for a simple solution to his expense tracking dilemma. You see, Stu doesn’t want to link his bank accounts to third-party online budgeting systems or deal with complex budget software programs when it comes to counting cash. Nope. Stu just wants a simple spreadsheet to get his expenses tracked with little fuss and no muss.

Since I like Stu, I went ahead and built him not one, BUT TWO expense tracker downloads. The first is a simple printable worksheet for carrying around in your purse or wallet. The second is a full-on expense tracker spreadsheet that does the math for you.

The only problem with Stu is every time I reply to his super nice email, my response bounces. It’s a bummer for this blogger ’cause I’d like to thank him for his idea.

Be an Expense Tracker

Step One: Download!

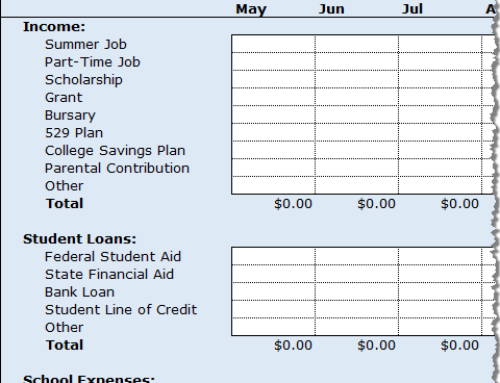

Download your preferred tracking method — the worksheet (PDF), spreadsheet (XLS), or both.

Fill in your spending categories across the top.

Download: Track Your Expenses Worksheet (PDF)

Download: Track Your Expenses Spreadsheet (XLS)

Step Two: Track your daily spends

Save your receipts and tally your spends every day. It may seem like a lot of work at first, but over time you’ll find that a daily money tracking system is an easy habit to keep. Just be sure to track all your cash, credit card, and debit card purchases to see where you’re blowing your dough.

Step Three: Add spending totals to your budget

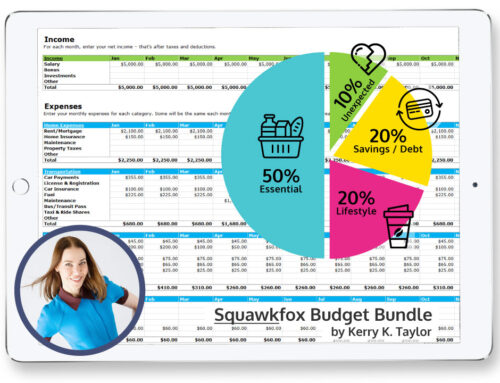

Tally your expenses during the month and add them to the Free Budget Spreadsheet under the right category. I’ve written a whole series on budgeting called: How to Build a Budget. There are a dozen free downloads, worksheets, and spreadsheets throughout this series to help you get your money on track, so go check it out.

Final Steps: Improve your personal savings rate

I want you to Fall in love with your Personal Savings Rate and increase the percentage of your saved income by not consuming it. GULP!

Yes, you can do this. I have a hunch that after tracking your expenses, you’ll see the shopping patterns and spending places where you can cut back. So cut back, and use that found money — which is YOUR MONEY — and save it in an emergency fund, reduce debt, and increase your net worth.

Happy tracking, and thank you Stu!

I used to use spreadsheets like this and they are great for keeping track of where you spent your money, but knowing what happened in the past is really only of limited usefulness. Like Stu, I also didn’t want to put all my financial info and bank details into some 3rd party website. Also, I couldn’t find a website that had decent budgeting capabilities. In the end, I found YNAB (You Need A Budget). It allows you to set a budget and monitor you performance in adhering to it. It also allows you to change things as you go since life doesn’t always let you follow you budget exactly.

I’ve been using YNAB for 2 years now and it is the only financial software that I have ever managed to stick with. It doesn’t have as many features as Quicken or Mint or Yodlee, but it does budgeting spectacularly. There is also a really helpful online forum, online seminars and support from the company.

I guess this has turned into a sales pitch, which wasn’t my original intention (I don’t work for them), but so far, I haven’t found anything better. If managing you money going forward it what you want (not just looking at where the money you had has already gone), then good budgeting is what you need. For me, YNAB makes it tolerable and it works.

Spreadsheet like yours is a great idea to keep track of all your expenses. However, it is difficult for people to maintain their expense tracking month after month. I tried it but ended up losing interest in keep track because it just seemed to require too much extra effort. Not sure about cash expenses but if you are using credit cards, maybe mint.com might be a better alternative. What do you think?

I [meaning my loving wife] use Money Manager EX. It is open-source, cross-platform and pretty simple. It also has simple graphs to see where you spend and it AUTO saves every time you enter something so you just close it and it is saved (which was hard to get used to at first). Any system of entering info takes work whether spreadsheet or notebook paper, this one lets you be simple or add categories/notes to each entry. Also, FREE.

http://www.codelathe.com/mmex/index.php

Cheers!

I just want to thank you for your blog. It’s the only honest, free blog I’ve seen, and I appreciate your hard work preparing this. You’re the best! God bless you.

STU here,I haven’t tried it out yet but many thanks for building it.I’ll check it out right away.

Thanks again Kerry,

STU

SSMarie

I use Learnvest to track my spending and help with budgeting. I love this program. It keeps track of everything. If I pull out cash from the ATM I use an app on my phone called Spend to track that.