Can a community work together to increase its net worth by a million bucks? I think so, and I wanted to do my best to help. So I set up a frugal living booth at a quaint country fair and invited the savvy families of Aldergrove, British Columbia to pick my brain for simple ways to cut costs without cutting out the fun in life.

There was a catch though — the whole savings shebang was filmed for a new reality TV show called Million Dollar Neighbourhood, set to air on the Oprah Winfrey Network (OWN and OWN Canada). I was brought onboard as a Frugal Living Expert. Cool, eh?

“One hundred families in the community of Aldergrove have just 10 weeks to increase their collective net worth by $1 Million”.

–OWN

Me behind the scenes, in makeup.

I had a blast meeting around 100 families and taking part in the shoot. I was also pretty darn exhausted after sharing the same ten money saving tips over the course of a day. Because several families from the fair have emailed looking for my tips, I thought I’d post them here for everyone’s benefit. Here’s where to start saving to become a Million Dollar Neighbourhood!

1. Cut your landline.

Talk ain’t cheap if you’re texting on your cell phone and not using your landline every day — so cut it already! If you’re paying for a few special phone features on top of basic service, your family could save around $50 per month by cutting the landline.

Total Savings: A tidy $600 per year should get the neighbours talkin’.

2. Make you own cleaning products.

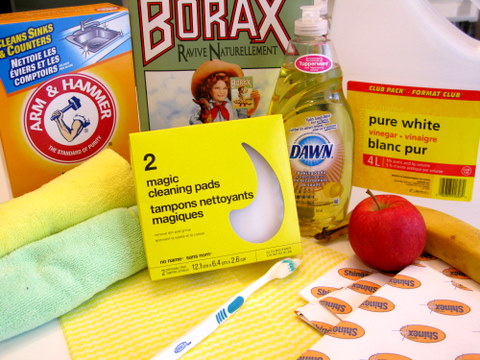

You don’t need to shop in a special supermarket aisle to sweep up some clean savings — all the ingredients you need are stocked in your kitchen pantry at home. These homemade cleaners won’t harm the environment, they are kid safe, pet safe, and one of them tastes great on French fries.

Ingredients:

- dish soap (not tasty)

- baking soda (tasty in cookie recipes)

- white vinegar (TASTY!)

- elbow grease (always free!)

Get my homemade cleaning recipes here: Spring Cleaning: 5 Chemical free ways to clean house for less.

Bonus: Microfiber cloths have many uses. They cost around $1 each and can be turned into a very frugal mop. See 4 Swiffer Cleaning Hacks for Cheaper Dust-Free Living for the frugal details.

Total Savings: Pledging to clean your home with kitchen staples, elbow grease, and microfiber cloths could save your family around $300 a year. If you own a dog, you could save more.

3. Switch to generic personal care products.

You don’t need to spend big bucks on brand name hair care products, makeup, and over-the-counter medications to get gorgeous and headache free. Making the switch to generic personal care products could save you up to 30% — that’s $360 per year for a family that spends $1,200 annually.

Switch Tip: Always compare brand name and generic labels to make sure you’re getting an equivalent product.

- Check dosage

- Compare active ingredients

- Verify that product volumes, weights, or sizes are equal

Total Savings: Cure the common cold (cough) with generics and save $360 per year.

4. Make your own coffeehouse style drinks.

I wanted to say: “Who loves an ice cold frozen Starbucks Frappuccino?” But I think the TV people preferred I called this tasty (expensive) treat a frozen blended coffeehouse style beverage. Try saying that on camera fast. Gulp!

Anynamegame, my homemade Frapp Attack recipe costs $0.32 and tastes just like the real thing thanks to the secret ingredient — a pinch of xanthan gum.

Get the recipe in this very popular post: Make a Starbucks Frappuccino for $0.32 and enjoy the cool savings.

Total Savings: If your family buys six Frapps a week, you can save up to $1,100 per year by blending your own at home.

5. Raise your insurance deductibles.

When was the last time you read your homeowner’s, renter’s, or car insurance policy? I challenge you to open those policy pages and check your deductibles to save a little — or a lot — of cash on your yearly premium payments.

A deductible is simply the amount of money you have to pay before the insurance kicks in. Raising these numbers from $300 to $500 or from $500 to $1,000 could save you between 15% and 25% on your annual insurance premiums. Besides, making fewer small claims can also help keep your premiums from increasing.

Total Savings: Pocket $300 per year by raising your deductibles and decreasing your premium payments.

6. Install a programmable thermostat.

This tip created a lot of brain energy, caused a few sideways glances, and generated some great discussions. I was surprised by how many people don’t own a simple programmable thermostat. These gadgets have a one-time cost of $30 to $50 and can save you up to 10% on your energy bill by automatically turning down your heat at night and when you’re away. It’s kinda like magic, but not. Yes, you need to read the manual. No, it’s not difficult. Yes, you can do it.

Total Savings: Turning down the heat in the winter or dialing up the air conditioner in the summer can save you $180 a year. If you live in large home you’ll save even more!

7. Start a compost.

Composting can eliminate the need for synthetic fertilizers, saving you at least $50 a year on gardening costs while reducing the chemicals around your home and protecting your kids and pets. A simple kitchen compost can also reveal how much food you’re wasting — a huge budget buster.

You don’t need a fancy compost container to get the frugal job done. I use a simple airtight $10 container and store it under my kitchen sink.

There are rules for building a better compost. Check out How To Compost Without Raising a Stink for the green thumb details.

Total Savings: Show a little environmental responsibility by creating fertile soil and save at least $50 a year on garden costs. Your kids’ grandkids will thank you.

8. Do your own manicures and pedicures.

Do we have any glamour girls or guys in the audience? ‘Cause I’ve got a handy tip to save you around $600 a year. Those who regularly visit a salon for pricey manicures should be biting their fingernails — yeah, it’s time to handily cut this cost.

Spending around $50 monthly for a nail buff and polish is silly. Sorry. Especially when a bottle of nail polish costs under $10 and nail files can be bought for a buck at your local drugstore.

Total Savings: Cut your mani-pedi pampering sessions, learn to do your own dang nails, and save at least $600 bucks a year.

9. Cancel your newspaper and magazine subscriptions.

I dare you to make a list of all the newspapers and glossy magazines you pick up at the news stand. Or maybe you’ve got a monthly subscription for a few periodicals.

Why?

There’s this place called The Internet, and you can browse all this stuff online for free. There’s also this thing called The Library — it’s a great place for those who love touching glossy fashion mags and have the need to flip through a few pages. The library lets you borrow older issues for free.

Total Savings: Skipping your subscriptions and that random magazine check-out purchase could save your family around $125 per year.

10. Wash in cold, hang to dry.

It’s hard to say something clean and refreshing about such a dingy topic. But a little dirty talk here today could save you $180 this year if you turn off your dryer and wash your clothing in cold water. Washing in cold and hanging your gear to dry prolongs the life of your clothing and reduces the amount of energy needed to power your machines. Easy.

This filthy post gives you all the dirty details: How to Save Money on Laundry

And yes, I really hung my shirts in the middle of our hay field to get this shot. I always go the extra mile for you guys. Enjoy!

Total Savings: A clean $180 in dirty savings is yours by washing just five loads a week in cold, and then hanging those fabrics to dry.

I’d love to thank Bruce Sellery for this amazing opportunity. As he is the show’s host, a personal finance expert, business journalist, and author of Moolala: Why smart people do dumb things with their money, I was thrilled to take part in the savings extravaganza.

Your Turn: What money saving tips would you share with a TV audience?

Very well deserved Kerry. Congratulations.

All excellent tips, not that these are unknown, but great to refresh the mind. We don’t even have dryer, hanging keeps inside air cool and reduce energy bills

Congrats!

Seconding DIY cleaners. There’s this fantastic show on BBC called “How Clean is Your House?” where these two women teach people how to clean things. It’s actually quite fun to watch, in part because almost everything they use is homemade–and it works when you do it, too :-). I think lemons are a bit more costly than generic cleaners, but they smell a lot better 🙂

On that note, though: if you clean with microfiber/rags, and you run it through a cool wash, will that get it clean? We still keep a roll of paper towels around, for the truly germy messes, but I’d imagine that even with normal usage, a cloth rag would get pretty manky pretty easily.

Thanks for the good ideas. Every little bit helps.

Good tips 🙂

Looking at your photo reminds me of a huge saving tip for make-up removal. I always use cold-pressed olive oil instead of expensive, artificial make-up remover. Not only is it a fraction of the cost, but it also serves as a natural wrinkle prevention.

I haven’t cancelled my paper, but have switched to the (much) cheaper online edition. I have thought about cancelling the land line, but a few considerations have deterred me. One is that in an extended emergency or power outage, land lines still work. Another is that people “talk” on land lines. Having regular conversations by phone with family members via a good long distance plan is an important way to stay in touch and close; cell phones can be invaluable, but few plans allow for extended long distance conversations.

Here are a few more – how about eating in? Groceries cost WAY less than eating out, especially if you use your coupons. Here’s another – shopping for gifts early – that way you can take advantage of sales. And one last – getting organized! Having all of your ducks in a row always saves money – no late fees, no penalties, no getting stuck having to buy something at full price because you need it NOW. Thanks for the money saving tips!

Loved all your tips! If I have things that come out of the dryer wrinkled I put them back in the dryer with a wet cloth for just a few minutes and they come out wrinkle free and don’t need to be ironed. I only put in a couple at a time.

Congratulations — I look forward to seeing the episode. I just bought your book from amazon this week and devoured it in a single sitting! Also picked up Teacher Millionaire and the Wealthy Barber returns based on your good reviews. Keep up the great work! Thanks!!!

Always educational reading your articles.

Did you also at one time, have an article about insurance types, and costs?

Great find on the internet:

Under arm deodorizer—–Splash apple cider vinegar under your arms before getting in the shower. Massage in and rinse off. Do not use any soap (leaves a film). When you dry off, dust baking soda very lightly under your arms. I could not belive how well this works!!!!

This is so awesome, I CAN’T STAND IT!! Go, you!!

Save on shampoo and conditioner: 1 Tbls. baking soda to 1 quart water for shampoo (massage into hair and scalp like shampoo) and 1 Tbls. white vinegar to 1 quart water for conditioner (pour over “shampooed” hair and rinse with water)

Hair is amazingly clean and shiny!!

I do agree that magazines are a waste of money IF you pay for them. I have gotten some free (Martha Stewart Living, Everyday Food, etc.) by using my points from http://www.recyclebank.com. I’ve also received free magazine subscriptions from http://www.freebizmag.com. No commitment and no credit card required for these ever.

Hey Kerry.

Your blogs are amazing. I also have to agree that Newspapers and Magazines nowadays are not useful because you can see anything online and even download stuff FREE to e-books. I also agree that we should avoid places because we do tend to pay a lot for something which we can make at our own time at our own houses. The contents of your blogs are interesting and amazing. Good luck with your ventures in saving money.

Congratulations for getting on OWN. I will continue to read your emails, but won’t be watching the show. I do not pay for cable TV, except for a $10 a month package which gives me better reception than just an antenna. OWN is in a higher priced package level. I haven’t watched Oprah since she left the networks.