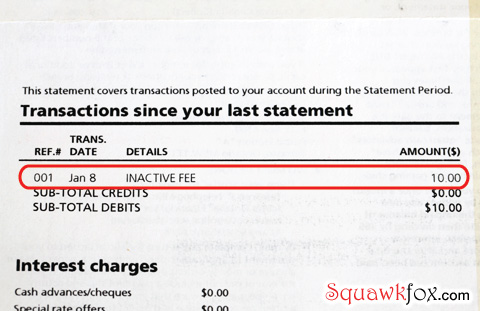

I’ve been called many things in my life, but “inactive” is not one of them. I’m physically active (I’ve raced Ironman), I’m sexually active (I don’t kiss and tell), and I’m proactive (I get things done). So when Scotiabank charged my Visa a $10 inactive fee this month, I nearly fell off my reactive butt.

What the heck is an inactive fee, and how did I attract such idiocy into my wallet? I skulked around the interwebs for a possible answer, ’cause the interwebs are comprised of cranky credit card customers, right?

Turns out I’m not the only lackadaisical shopper stooped by inactivity and charged with inane credit card fees. But since most people use their credit cards, locating others with my inactivity problem required some serious Back to the Future time travel — I had to return to the year 2006 without a time traveling DeLorean.

Related: What order should I pay off my credit cards?

The Red Flag Deals Forum — a vocal group of fiscal frugalists — had 2006 experience with no-fee Visas and $10 inactivity fees. Some thought the idle fee was automagically billed if you failed to shop while carrying a credit balance for a year — which means the plastic bastards owe YOU money. Others thought the fee was just plain stupid.

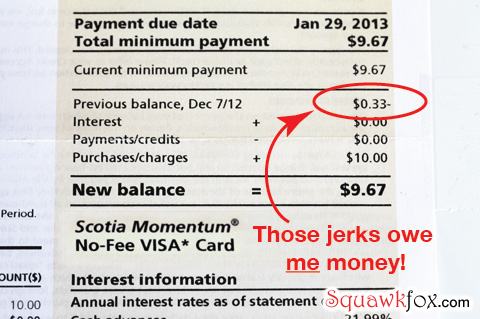

I think both. Turns out my Visa has owed me the princely sum of 33 cents for nearly 12 months. I should charge those jerks interest — maybe then I could afford that DeLorean.

Now, being who I am (a curious blogger thing) with a love for most things Michael J. Fox (Teen Wolf sucked), I decided to DO something, and sitting idle with inactivity wasn’t one of them. So I called Visa (while wearing Back To The Future approved purple Calvin Klein underwear).

How to reverse a credit card inactive fee

Call up your creditor and try a script kinda like this.

Visa: Please choose your own adventure by punching a bunch of dumb menu options. Enter your credit card digits, say your name, give us your birth date, tell us your Mother’s maiden name, give us those three numbers on the back of your card, enter your bra size, and verify the age you lost your virginity. Perfect, now listen to Muzak…

Me: Thinking … I wanna eat my phone … 8 minutes later … RIIIIINNNG!

Visa: Hello, please verify your card number and the digits on the back.

Me: I already entered that stuff, and I don’t want to revisit the whole virginity thing again.

Visa: You just need to verify, Ma’am.

Me: I’d rather verify my $10 inactive fee, and clarify that we can do something more awesome with that money, like reverse the charge! Is it ’cause Visa owes me 33 cents?

Visa: The $10 inactive fee is charged to all cardholders who have not used their no-fee credit card for 12 consecutive months. Nothing to do with the 33 cents. Many credit cards charge this fee, Ma’am.

Me: So I’m being punished for not shopping enough? AND you jerks owe me money!

Visa: Laughter. I guess so. But I can credit your account if you buy something small, something worth $10.

Me: So, I have to spend $10 before Visa will let me have my ten bucks back? This is a financial hostage situation. I don’t like the math.

Visa: I’ll monitor your account for the fee reversal. Have a nice day.

CLICK!

My inactive Visa situation is not unusual — many credit card companies will punish you for taking a year off shopping. Buy nothing for 12 months and get slapped with a cool $10 to $25 inactive fee. The power is in being familiar with your cardholder agreement, and keeping up with the ever changing world of credit card fees. And beware of paying another sneaky fee — credit card balance insurance — here’s why 5 Reasons to Avoid Credit Card Balance Protection Insurance.

Sleuthing your credit card fees

I don’t love reading cardholder agreements either — the text is small and the language is painfully unfun. But do try. There are other places you can find the fee-hungry damage various financial institutions can inpart on your plastic, though.

Canadians can start with the Financial Consumer Agency of Canada’s Credit Service Fees Comparison Table. Give this page a scan, find your credit card, read the footnotes, and get in the know.

Americans have the Consumer Finance Protection Bureau’s Credit Card Consumer Guide to get a plastic education. Go read it, now.

Next, take a peek at your bank’s website. Most financial institutions have a credit card section where they list ‘fees at a glace’. If you don’t like what you see, switch cards.

What did I buy for $10?

When a bank holds my money hostage because I don’t shop enough, I get a little hostile. I then get creative.

Since the cash was basically a wash, I decided to clean my hands of the insanity by spending the $10 on something that makes me happy. So I walked into my grocery store and bought a bunch of non-perishable food items. I then donated the lot to a local food bank. I figured, while some banks are jerks, other banks are pretty darn good.

I’ll be cancelling this credit card once the fee is reversed.

[Related: Are you paying just the minimum balance on your credit card?]

Until then, maybe someone could donate a DeLorean to us? I have an active imagination, and cruising past my former bank in a cool car with one less inactive credit card could be fun. We could flip them our doors. I’ll wear my purple panties. Promise.

Love love love,

Kerry

It’s seems to be a $10 theme! I got $10 back last week from my bank CIBC, they charged me $5 for an overdraft fee (I wasn’t overdrawn!) and then I was also charged $5 for using my e-savings account at the ABM, (when I didn’t!) there are no fees as long as you only bank online with that account, which I do! I didn’t have an issue with them crediting my money but it just goes to show you how we really have to check up carefully on all our statements and transaction. $10 is $10 🙂

I also was charged $10 last week by my bank CIBC. They charged my $5 for going overdrawn (I wasn’t!) and another $5 for using my e-savings account to withdraw funds at the ABM (I didn’t!) I didn’t have a problem getting the charges reversed but it was a hassle calling them (especially being subjected to listening to that Muzak, agreed!) It just goes to show how we have to be careful checking our statements and transactions, for sneaky “extras” the banks are getting rich off of at our expense. After all with your $10 and my $10, we are way closer to owning a DeLorean now ! 🙂

My solution is to set up a monthly donation (mine is to Plan Canada) and pay it on the same day each month. That keeps my account open, the fee at bay, and a little help to our friends in need.

Not to get off topic, but beware of banks doing the same thing with savings/chequing accounts that are inactive. The Royal Bank charged my sister $20 for simply not using it enough. Outrageous! Yet another cash grab by money-grubbing banks.

Well, this would make go ballistic. I have no idea if my President’s Choice Mastercard charges a similar fee for inactivity (just like you, I don’t read the fine print) but my Mastercard gets a good workout each month. I use for absolutely each and every purchase (unless it is a store where they charge you extra $.25 for paying by a CC if the cost of the item is less than 5 dollars) so there is no danger of the account being inactive.

But, at least they reversed the charges if you spent $10 – that actually is not such a back deal – you spend $10 and they give you your $10 back but at least you have the merchandise.

It is a terrible practice. I don’t use Visa. I have MC and Amex, which I use because I collect Air Miles, but the whole business with Air Miles is turning ridiculous as well so the time may come when I will ditch the Amex and keep only the MC.

Kerry,

You’re the only money blogger I read out loud to my wife. We’re big fans!

Cheers,

Andrew

There’s the withdrawal fee for taking funds out of the TFSA more than once a year. I moved my TFSA in a lump sum because of that.

Same thing happened to me. Overpaid my VISA card a year ago, and left the $12 sitting there, intending to use it the next time I used this card (which I keep for emergency purposes – like when the bank cancels my other VISA card when it gets compromised.) Sure enough, after a year they grabbed $10 of the amount I had left on deposit on this card.

I was also charged $5 when I transferred some funds from my e-savings account to my US$ savings account on-line. It seems I should have known that free on-line transactions don’t apply when a US$ account is involved. Next time, they told me to move the money to my CAD savings account first and then to the US$ one. Twice the work for me (and for them), but at least it saves me $5.

Both of these happened at CIBC.

That happened to me with my Royal Bank Visa. I was sent a letter telling me that if I didn’t charge something to my credit card within 30 days I would be charged $10.00. Since I have so many credit cards (and yes, I do pay my credit card balances off in full every month) I filed this letter under G. Low and behold, the next statement came in with the $10 charge. I called the credit card company and told them to cancel my card as I was not going to be bullied into using the card. Well, talk about back tracking…..I was assured that the charge would be reversed. As I have other cards that I use all the time, I wouldn’t miss this one. I no longer have this account.

Love your website btw!

Maureen

After we were married I had a card which we never used. We were continuously billed for $000.00 so after a year we decided to cancel our card, they sent a final payment due of $000.00 threatening to send a collection agency. After several phone calls the supervisor gave up and said send a cheque for $000.00, and after that they did cancel the card. We have heard from them again !

I was going to get a pre-paid visa for my nephew for Christmas, but the fees were outrageous! He got cash. If he wants to order something online, he can get me to order it.

Has anyone tried the MOGO prepaid VISA cards?

Shelly, like you, I gave cash instead of prepaid VISA because of the fees. Then I heard about MOGO, which sounds like it would solve the problem and would allow ordering online, but I haven’t tried it yet.

Yup! I saw that too when I was deciding if I was keeping a card at all. It is amazing how people who barely know you get jittery that someone is considering going without a credit card – it is like their personal house of cards might collapse on them and their interest charges. I cut it up a year ago, paid it off (have been paying interest on a card since I was 19 – clearly I cannot be trusted with one) and shut down the account this week the minute the final payment cleared. I now have a VISA debit card which I can use more and more for online purchases or I get prepaids for online (they are only to be used online). Beware your prepaid though – they charge MONTHLY fees – you can put it in your wallet and go to use it and find out the 50 dollar card you put in there 5 months ago is only worth 25 bucks!! Buy it and use it within the month! I also have a paypal account. Basically can’t buy anything unless I have the dough in the account. I feel POWERFUL!!!

I received a letter from Royal Bank not long ago telling me that they were going to charge me a fee as I hadn’t used my savings account in a year. I needed to either make a deposit or withdrawal within 10 days or I would be charged the fee. Makes me think my $$ would be safer under my mattress or in the cookie jar.

I will be reading my card rules a little more diligently and yes I am another frugal person (and it does pay off). Can anyone top this one? I had a TD card years ago and when I got married we moved to another home and I forgot all about that card that had no balance anyway. The people who bought our home kept receiving a statement in my name for a couple of years. They finally called me and were quite irritated that I had not cancelled this card and were tired of getting my mail. Turns out that they owed me $.02 and spent a lot of money on stamps to let me know. I now have a Dividend Visa with CIBC and last year I got paid a dividend or $98.00, not too shabby, and no I do not keep a balance. Guess someone has to pay for my dividends, LOL However, I will be watching them.

CIBC seems to love their fees.

I have the Every Day Chequing account.

In 2012 January I counted all my transaction fees for 2011 for a whopping $270!!!

I called customer service and was refunded the entire amount plus they added something onto my account where they credit any transaction service fees every month, going forward.

I checked again this past January for 2012 and found a $2.00 fee every month plus in October the fee reversal slipped off. I was being charged $32 a month for transactions.

I called costomer service which is in Halifax and found the $2 fee was for using a passbook (I don’t use one) and yes indeed the fee reversal had expired. I was credited $90 for all the fees and going forward this year I will not have any fees for transactions.

You just have to call with your total fees they charged you, plus be a client for 10 years and ask for your money back.

I cancelled all of my cards except my AMEX. $0 fees. 100% of the time. And customer service that doesn’t make me cringe.

[…] don’t miss the latest rant from perennial favourite Kerry K. Taylor’s (aka Squawkfox) about credit cards that charge a $10 “inactive fee” for not shopping […]

I had a bad Scotiabank day today. My mortgage statement came. A $390 “adjustment” fee. I called – it was bc I didn’t send in my home insurance policy. Turns out they sent the letter to ask for it to my childhood address…I haven’t lived there in 15 years! But they have my correct address for my mortgage statement! (Different address on my general file). I have to go into my local branch to get it corrected…can’t be done over the phone. The branch hours are from 9:30-4:30 most days. Overall, unacceptable. As soon as our mortgage term expires I am switching lenders.

[…] Squawk Fox says to watch out for silly credit card fees […]

they are quite cruel to have those charges. you may try to mail your lawmakers about it. in Philippines there is a senate bill 3333 and senate bill 3534 which protects consumers against credit card companies. you may check it out to see what can be applicable.

[…] Squawk Fox- Stupid Credit Cards Charging a $10 Inactive Fee […]

They are hoping that many people won’t notice the $10-25 fee especially if they have pre-authorized payment for their card. It is essentially stealing since no goods or service has been provided. They have to call it something hence “inactivity” fee.

Last week I had to go to Scotiabank to get a PIN number for a new debit card they sent me. There were so many questions, it felt like the Spanish inquisition. Even when I stopped talking she was furiously typing away.

Bank fees have become absurd. My wife got hit with a $25 fee for having an inactive savings account. Yeah, a savings account. This was at a bank that offers us “premier” service.

Thanks for the heads up. I think I’d better buy something with my card as it’s been about a year and I *HATE* having to phone.

Cheryl asked about Mongo Visa cards. They have a few problems:

“90 Day Card Inactivity Monthly Fee $2.99”

Once the balance is zero, the card is cancelled.

“Live Customer Support $1.49”

So if you object to this, you get changed to talk to them about it.

Oh, the other things that make me nervous are:

Mogo got it’s start in the payday loans business (charging 52%/year interest, which is pretty reasonable for that type of business).

They insist on a credit check for a pre-paid card.

They allow you to go over your pre-paid limit, but won’t specify what interest they charge if you do.

“If you attempt to make a transaction for more than the value available on your Mogo Card, the transaction ***may*** be declined.”

Mogo might be a good solution in a few cases, but it seems like it could be very expensive if you aren’t careful.

Emphasis is mine. All quotes from https://www.mogo.ca/pdf/Mogo_Prepaid_Visa_Card_Terms_Conditions.pdf

Thanks for your thoughts on this.

Here’s a thought: make a purchase from home depot and when you get the inactivity fee reversed, return the purchase and get that money back as well. I suggest home depot because they’ll allow a return more than 30 days later.

That’s completely absurd; although I presume they clearly must put this in the terms somewhere? so I guess you have no legal right to disagree, if that is the case… but, on principle – that’s very silly.

my credit union Vancity charge me $20 for not using my account for a year. i switched credit unions because they wanted me to pay $7/month for unlimited banking with my chequing account. no! so i switched the account type to a “pay-as-you-go”, just in case. of what, i don’t know. Vancity is BC’s biggest credit union and the one all us lefties love to belong to, but i was livid when they wouldn’t reverse the charge, so i closed my account. haven’t looked back.