Now that you have started your budget, let’s continue by finding your Net Worth.

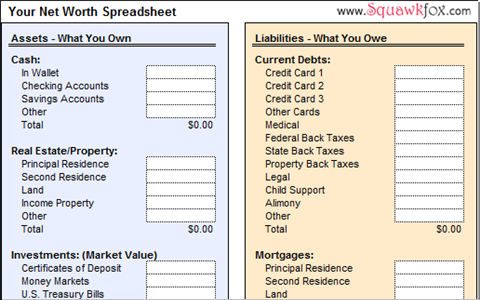

Download: Your Net Worth Spreadsheet

What is Your Net Worth?

Your net worth is a vital financial planning tool. It serves as a barometer for your personal financial health and helps you establish a baseline to measure your progress towards your financial goals.

If you’re married or have a partner, it’s a good idea to account for your assets together in a household net worth statement. Couples often calculate their individual net worth first to see how each of their retirement plans are doing, then add the results together to calculate their household net worth to complete the picture.

Finding either your individual net worth or your household net worth sounds scary, but really it’s just this simple calculation:

Financial Assets – Financial Liabilities = Net Worth

What You Own – What You Owe = Net Worth

If your net worth is a positive number, then you own more than you owe. If your net worth is in negative territory, then you probably have debt.

When crunching your money math, it’s important not to confuse your net worth with your self worth. Don’t let a negative number give you a case of the ‘sads’. Having debt doesn’t make you a bad person, and having a million dollars doesn’t make you Ms. Wonderful either.

This may sound strange, but your net worth number is not the most important factor in doing this exercise. Surprised? What is important is how your net worth changes over time and the direction it’s going. The idea is to move your net worth into positive territory, and increase it over time. In order to gauge the direction your net worth is headed, you need to calculate it regularly, and objectively chart your progress.

To get the details on what counts as an asset and a liability, check out How to Find Your Net Worth for more information.

Now take some time and find the paperwork for all your financial assets and liabilities. And don’t forget to download the Net Worth Spreadsheet to get the job done.

Love,

Kerry

Next Steps: Check out Day 4: Deal with debt