Congratulations on all your hard work. Today I’d love to share five free downloads and tools to help you build a better budget and prepare for the future.

1. Start Your Emergency Fund

Yes, you really do need an emergency fund. When tough times happen to good people, it helps to have a financial safety net to deal with life’s expenses. Check out How to Start an Emergency Fund on any Budget for the easy-to-follow steps.

2. Set Your Financial Goals

Setting financial goals throughout your lifetime is an important part to building a budget. Financial goals can address your immediate needs, your long term dreams, and everything in between.

Download: Financial Goals Worksheets

Everything is possible when you identify your personal financial goals and develop a plan for reaching them.

3. Track Your Medical Expenses

If you need to keep additional records on medical expenses, go ahead and download the Medical Expense Tracking Spreadsheet.

Download: Medical Expense Tracking Spreadsheet

Over the years I’ve used it to track various doctor, dentist, and physiotherapy costs, and a few non-traditional health care costs as well.

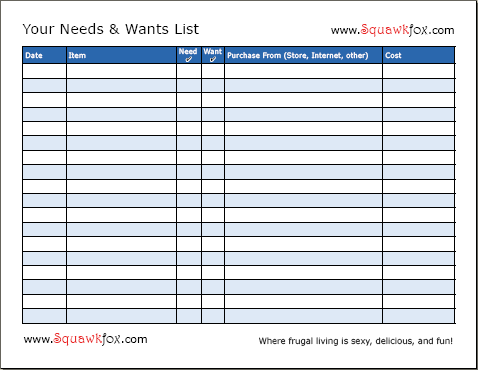

4. Your Needs List and Wants List

Just like keeping a food diary or tracking your exercise with a workout log to get physically fit, writing down your needs and wants on a list can help keep you on the right fiscal track.

Download: Needs List and Wants List

I’ve included these worksheets to give you pause for thought when you’ve got some extra cash and need a reason to spend it on the important things in life. There’s even one for your kids, for when you’ve got little ones looking to learn about the value of money.

5. Your Holiday Expenses

Sure, the Budget Spreadsheet has a space for the holidays, but I think a specific spreadsheet geared towards tracking holiday expenses can better help you deal with the varied costs of birthdays and your particular festival of fancy.

Download: Holiday Expense Tracking Spreadsheet

Download: Holiday Expense Tracking SpreadsheetBy tracking your costs during the holiday season, you will be able to get a grip on where the money is going, where you’ve spent the bucks, and when you’ve hit the end of your budget.

Love,

Kerry