After years of very low interest rates, the Bank of Canada raised its key interest rate by another quarter of a percentage point, up to 4.75%. This is the second increase this year and the 9th since the central bank began raising rates last year. Given our deep level of indebtedness — hey, our debt-to-income ratio is at 170% — Canadian consumers can expect to feel some financial effects following an interest rate hike.

After the first interest rate hike, CBC’s The National invited me to do a live Q&A with Jacqueline Hansen where I answered dozens of personal finance questions on Facebook. My advice is very relevant in our rising rate environment. Yes, go watch.

What the heck is an interest rate hike?

The Overnight Rate or Key Rate or Benchmark Rate is what banks use to charge each other money. When this rate goes up the big banks typically raise their prime rates and pass the expense on to consumers — a move that will increase the cost of variable-rate mortgages and other loans tied to the benchmark rate.

When rates hike upwards, important financial decisions have to be made. Here are 6 Ways an interest rate hike affects your finances.

1. Mortgages

Variable-Rate Mortgages

Borrowers with variable-rate mortgages, or adjustable-rate mortgages, will see an increase as financial institutions increase their lending rates. Don’t be fooled if your variable-rate mortgage has a fixed payment, ’cause you’re likely still paying more! For each mortgage payment you make, a portion is interest and a portion is principal. When rates go UP, you still make the same payments — you just pay more interest and less principal. So while your monthly payment may not change for the term of your mortgage (i.e. 5 years), you’re putting less equity into your home and it will take longer to pay off your mortgage.

How much more will you pay? Assuming monthly payments, a 25-year amortization, and an interest rate change from 4.00% to 4.25%.

- 200K Loan: $1,052 -> $1,079 = $27 more per month ($324/year)

- 500K Loan: $2,630 -> $2,698 = $68 more per month ($816/year)

Solutions: Stress Test your mortgage!

If you’re in the market, do read my popular post Can you afford to buy a home? where I offer tips on stress testing your finances and a real life housing affordability calculator. This is a bull$hit-free post without the bias of banks, lenders, family, or friends swaying your home buying decision. If you or a friend is thinking of buying real estate, this is a must read.

Fixed-Rate Mortgages

Canadians with a fixed-rate mortgage won’t have to deal with the impact of an interest rate hike until it’s time to renew at the end of their fixed term. But be prepared for mortgage renewal shock because your next renewal will likely involve a higher mortgage payment.

Resist the easy solution to lengthen your amortization to ease the load of higher rates. Your payments will fall, but you’ll be mortgage-free at a later date than before while paying thousands more in interest.

Solutions

Is it time to lock in with a fixed-rate mortgage? Those with a variable-rate mortgage should consider if now is a good time to lock into a fixed-rate mortgage. While variable-rate mortgages have been a long-term money saver in a low rate environment, a fixed-rate mortgage offers two layers of protection:

- Your payments are the same for the term of your mortgage.

- You remove the stress and worry over rising rates.

Use a mortgage broker for shop around for the best rates, ok!

Consider a lump-sum mortgage prepayment. Lowering your principal today means less to finance at a higher rate in the future. Even if rates don’t rise, you’ll save on interest costs over the long term.

2. Home Equity Lines of Credit (HELOCs), Lines of Credit (LOCs)

When the Bank of Canada raises interest rates, you bet your bottom dollar that LOC and HELOC rates go up too, causing monthly interest payments to go up, up, and more up.

The problem? As home prices increased over the last few years Canadians went on a spending spree (a binge, really) by tapping their HELOCs and treating their homes as ATMs. The result is the average outstanding balance on a HELOC sits at $70,000, says the Financial Consumer Agency of Canada.

The bigger problem? HELOCs are considered to be persistent debt – people often just pay the monthly interest and don’t pay off the principal until they sell their home.

Rising rates will make HELOCs even harder to pay off. Sure, you can keep onside with a HELOC by paying the interest owing every month and not touching the principal, but as interest rates rise, it costs more AND MORE to just maintain that HELOC.

The real danger is HELOCs are callable loans. Banks can demand repayment of the whole darn thing at any time for any reason. Miss too many payments? Lose your job? House prices dropped? All these scenarios could trigger banker demands to repay your HELOC.

3. Student Loans

Student loan interest rates can be either fixed or variable (floating). As with mortgages, those repaying a variable-rate student loan will see their interest rate go up immediately, while those on fixed rates won’t see a jump until it is time for renewal.

4. Credit Cards

Call up your credit card issuer and ask if you’re charged at a at a fixed rate or a variable rate. Chances are you’re fixed, as this is how most cards charge interest. But there’s no rejoicing if you’re fixed at 19.99%, miss a payment on your credit card debt, and then get charged a higher interest rate on your outstanding balance.

With the average Canadian holding $3,954 in credit card debt, it pays to get outta this high interest cycle and pay down more than the minimum.

5. Car Loans

Low interest rates combined with car loans lasting up to SEVEN YEARS have driven consumers to purchase more and more expensive vehicles. A report from J.D. Power shows the average monthly car loan payment was above $600 in April and 52% of new vehicle loans had terms of seven years.

If crying over the cost of a depreciating asset isn’t enough, those few Canadians with variable-rate car financing will see a jump in the cost of their ride. But since most car loans tend to be fixed-rate, you won’t see an increase unless you need to refinance or purchase a new vehicle.

6. Hello, Savers?

While financial institutions are quick to raise interest rates on mortgages and loans, they’re super slow to increase rates on high interest savings accounts (HISAs) and GICs. Yes, banks pinch borrowers and scrimp savers, but watch for GIC and savings rates to very very slowly drift higher as interest rates hike higher. Savings rates often lag behind inflation, but look to credit unions and online financial institutions to offer the more competitive saving rates.

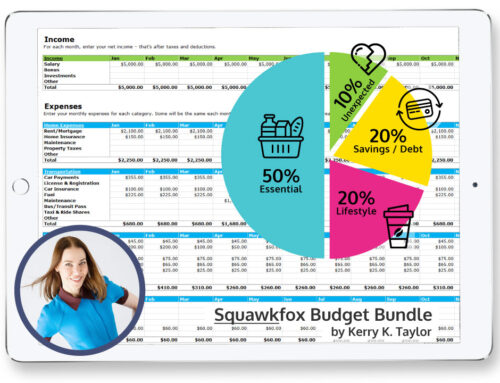

Solution: Make a debt repayment plan.

Get on side with your LOC, HELOC, credit card debt, and loans by using my free Debt Reduction Spreadsheet.

It’s not sexy and it won’t make the payments for you, but it will help you track your creditors, list the balances due, get real with the interest rates on your debt, outline your monthly payments, and make a debt repayment plan. Make a solid effort to pay more than the interest owing, and bite into that principal before it bites you.

Love love love,

Kerry

Great post Kerry. Thanks to you we have been working on the plane you give here for quite awhile. Now that rates are rising again we feel less vulnerable than we were before we started.

Thank you for addressing savers. As someone without any debt I was wondering how this might affect me right now. Still saving away for a house purchase…

Being an Entrepreneur. I can imagine sometimes the desperation for a company to grow. You start looking for resources. Then you run into loans. You get the loans expecting a certain return(ROI). It ends up being an unrealistic expectation! What do most Entrepreneurs do? Get more into loans. As entrepreneur its my opinion we should get a loan that is reasonable. We have a dependable income. Make a re-seasonable payment plan!

Kerry, what you mentioned about people getting con=fused between payment as a whole and the equity is true. There are so many people out there who gets attracted by variable -pay mortgage as they think it would be beneficial. However, they are uncertain about the principal which is contributing to build the equity is proportionally less and therefore the interest is anyways going to the income of bank at the same speed. A mush read article for anyone who is planning for a housing finance. Thanks for sharing…!!

Personally, I think car loans will be the next bubble to burst and drive (no pun intended) the economy down to another recession. It’s alarming to see more people financing vehicles for 7+ years. In my opinion, if you have to finance a car loan for more than 4 years, that means you can’t afford the vehicle. This is eerily reminiscent of the housing crash of 2008 when subprime borrowers were buying homes that they couldn’t afford. Additionally, there is an increase demand for second-lien loans like car title loans. This indicates that more borrowers are having financial difficulties paying their car note and now they’re using title loans as a short-term solution, a big no-no.

What about seniors like me who still has an 80% line of credit on my home.

I get no reasonable increases in OAS or CPP & personal pension is fixed for life.

Will be forced out of our home if this continues.

Using the CPI to calculate increases in OAS & CPP doesn’t reflect the true cost of living increases.

The CPI is based on fake info provided by businesses, etc.

Thank you for the article. It’s a very nice blog on the interest rate. Thank you for the sharing.

Yikes! I didn’t realize credit cards get affected by interest rate hikes as well!

These all six points affect finances a lot. Rising Fed rates can have a Cascading Impact throughout the economy including housing. With the increase in Federal Reserve rates, financial institutions are quick to respond by raising rates on new fixed-rate loans.

With interest rates rising, and the debt to earnings ratio getting more out of whack, the idea of saving for retirement is practically impossible. Investing is virtually a joke. Can an argument be made to tackle one’s debt moderately (ie. enough for it to be noticeably getting smaller) and invest the “extra” money?