I’m dropping the B-word today. BUDGET! There, I said it. It’s funny how this simple 6 letter word has the power to strike fear into the hearts of some and cause serious indigestion for others. If your heart is fluttering and your stomach just lurched, then you’re not alone. I’ve been there.

Despite it’s reputation for being boring, time consuming, and out-right tedious, creating a budget can actually be a liberating experience. You’ll have a plan for your money — so no more sleepless nights.

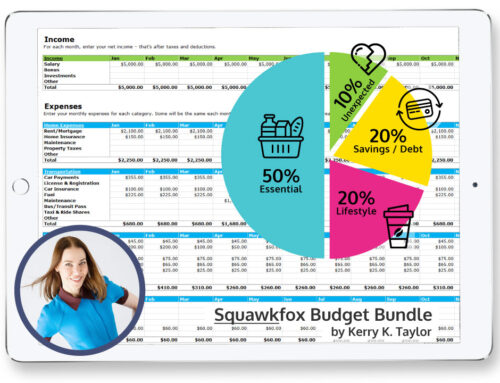

Keeping on track with a budget can show you where your money goes and help you plan for life — maybe you’re saving for a home, buying a car, going on vacation, saving for school, getting out of debt, starting an emergency fund, or just finding ways to save money. Whew!

It was, after all, through expense tracking that I managed to pay off my student loan in six months and started investing in a couch potato portfolio. Mind you, by tracking spending I also discovered I was spending $75 a month on olives. For real. OLIVES!

A simple budget can help you reach your financial #goals sooner — with less stress and worry.

How to Budget Your Money {Beginner Series}

I want to make budget planning fun because it’s your money, and if you do the work you’ll get 100% of the benefits. Promise.

What is a budget? A budget is just a financial plan for tracking the flow of money into and out of your life. The idea is to find the sneaky money outflows, plug the costly leaks, and save more of the inflowing cash for the stuff the really matters in your life. A budget will also expose any mindless spending habits and help you to better plan your money goals.

This series can help you:

- Get started

- Reach financial goals

- Get out of debt

- Deal with freelance income, irregular work, gig economy work

- Start investing

You can do this!

I believe in you.

Love love love,

Kerry

Yes we do have a budget. It’s the only way we can keep afloat, as every penny counts for us. It allows us to track progress, rearrange if need be to cover unexpected expenses (beyond the budgeted emergency fund), and keep us honest with what we take out. Somehow the anticipated act of writing things down makes us scrutinize the possible purchase beforehand. It’s not all deprivation though, each of us has a small bit of mad money every pay check.

I couldn’t agree with you more that budgeting is key to financial success. I tried Mint.com and Justthrive.com for 3 months before making my budget. They helped me understand where I was spending my money and then plan on how to reduce certain expenses. Another cool program that incorporates both financial planning and budgeting is FinanceLogix.

Thank you for this upcoming series, I am very excited about it as I am just in the process of starting to create a budget for our family. Right now I am still in the stage of tracking our spending to see where it is all going! Our goals are ALL of the things that you mentioned – building some savings, paying off debt, vacation, etc. As I look forward, my fear is trying to keep that budget once I have made it (or, more specifically, encouraging my husband to keep it)!

I think budgets are one of the most important financial tools you can develop. Creating and sticking to a budget has been so important for myself personally, and for my husband and myself when it comes to meeting our goals. Never had much beyond a small amount of student loan debt to pay off myself, but money was always synonymous with fear for me. So when it came to taking steps to be independent, making a budget helped me to see that I didn’t have to be so afraid. Now that a lot of that initial fear is behind me, I love reviewing our budget with my husband because we get a chance to talk about our goals and see how long it will take for us to realize them. Knowing that also helps make decisions about our spending easier, since we’ve discussed our financial priorities and know how much money we have available in a pinch. Can’t imagine living without one now!

I keep a large-scale budget by automatically separating bill-paying money and long- and short-term savings from money for day-to-day expenses. I have never gotten good at smaller-level budgets, but want to try a cash-only-for-play-money plan, which would probably help with spending and also make Mint more effective at tracking my other stuff!

[…] How to make a budget @ Squawk Fox […]

I think budgeting is very important for any household. I also know of many retired people that still have to budget when they leave the workforce, so it’s something I feel that is important to embrace throughout life.

I’m looking forward to the series and will be by more often to check it out. First time visitor BTW – nice site!

[…] explains how to make a budget in an “unboring” […]

I have kept a budget for a long and some new tips would be welcome. Thanks for a terrific web site.

[…] Financial Planning Series: How To Make A Budget. Great Series on Making a Budget. […]

I have started and quickly given up on budgets many times over the years. I’ve tried many budgeting solutions from spreadsheets to software and found them all to be lacking. Most of the software is great at tracking what I had already spent, but not very good at budgeting. Spreadsheets help with creating a budget, but are tedious to update when tracking spending.

I found some software last year called You Need A Budget (YNAB) and have been using it for about 8 months now. It’s not just software, it comes with a money management philosophy (4 rules) and a website with very active forums and input from many users as well as the developers. It’s still not perfect, but it is by far the best system that I have found so far. I’m surprised that I actually like using it and I think their web community really helps with that.

I look forward to reading your series.

[…] How to Make a Budget (the unboring way) […]

[…] Financial Planning Series: How to Make a Budget | Squawkfox […]

[…] How to Make a Budget […]

[…] How to Make a Budget […]

Budgeting must also involves reevaluation and reassessment to make sure that our budget or plan is heading to its way. We also need to control and monitor if something is wrong.

[…] Financial Planning Series: How to Make a Budget — Includes free downloads, worksheets, and spreadsheets! […]

[…] Financial Planning Series: How to Make a Budget – Includes free downloads, worksheets, and spreadsheets! […]

thanks for this.

I like the goal setting worksheets.

I didn’t think at first they would help me out much. They do.

I leave them out on my desk and it helps me prioritize my needs and wants.

When I have a goal concrete in mind like that it prevents me from being impulsive and I continally can keep myself on track with a quick glance.

It helps me to put finances on the forefront, as they need to be, as they have suffered so much from not being on my radar at all.

I also feel much more in control with my finances, and do not feel ruled by them.

It might take me a while to achieve financial peace of mind, but at least I am doing something, and am on the way.

ps.how do I get rid of/change the picture associated with my comments? I can’t figure it out.

[…] and making a budget is always the first step. Preet recommends using Kerry Taylor’s Financial Planning Series: How to Make a Budget for spreadsheet […]