Go ahead and call me an unromantic gal, but I’ve never merged my money with my spouse. Some may say I have trust issues or that I’m controlling with cash — none of this is true. When it comes to divvying up the dough, my sweetie and I decided years ago to keep our cash separated, and we’ve stood together on this financial issue for over a decade.

Despite living nearly separate financial lives, we’re hardly alone in our spousal approach of divided accounts. A study of 1,200 households by the Raddon Financial Group, an Illinois research company, found that 48% of married couples have two or more checking accounts, up from 39% four years earlier. North of the 49th parallel the crazy Canucks take a similar stance on banking. According to a recent RBC poll, one-third of Canadian couples between the ages of 18 and 35 keep completely separate bank accounts, with only ten per cent holding all of their accounts jointly.

Looking for a way to merge or separate your bank accounts? Check out the Switch Bank Accounts Checklist for some handy tips.

So why are so many couples living together but checking (or chequing) apart? Perhaps it’s due to a higher divorce rate, an increase in two-income households, or maybe it’s because more people are getting married later in life. Since I shacked up with my sweetie in my late 20s, the last point resonates strongest with me. After managing our own money in our own ways for most of our lives, making the switch to fully joint accounts just didn’t feel right for either of us.

Anyhoo, whether you’re already married, looking to get hitched, or just living love in another arrangement (yeah, I’ve been there too), there comes a time in every relationship when a banking system is needed for paying bills and managing money. And your system needs to work when income levels differ and spending habits come into play.

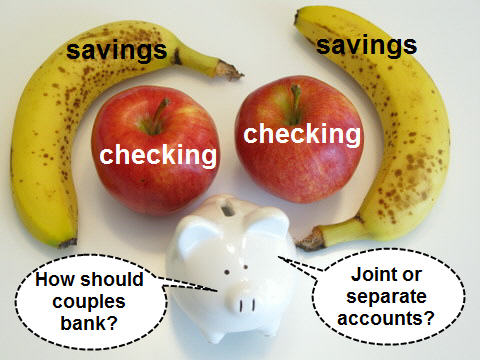

Should you mingle your money in a joint bank account or keep things separated? Your solution may not be similar to mine, so let’s weigh the merits of three very different banking systems, and you can decide on the best one for your spousal situation.

1. We Belong Together: Joint Accounts

Are you a couple that does everything together? Mingling your money into a single savings and checking account may either be the perfect solution or the start of some serious spousal financial strife.

Positives: As a couple with shared bank accounts you’ll streamline the money management process with fewer accounts to mind and less paperwork to file. Plus, you can save on banking fees! Paying for shared expenses (phone, mortgage, rent, cable) is also easy because all bills are paid from a single account. Lastly, there are no spending secrets when accounts are merged, so everyone’s accountable to the cash.

Negatives: “You spent how much money on lunch this week?” Good luck keeping a few splurges under the table when every transaction is open for your spouse to see. Couples banking with joint accounts have little privacy and independence since all money is pooled and neither person keeps their own ‘mad money’ account. Do you trust your partner to not drain the whole account and leave you with nothing? This method also challenges couples who make wildly different incomes since one earner may be footing a proportionally bigger chuck of the bills.

2. Keep ‘Em Separated: Separate Accounts

I doubt June and Ward Cleaver (of Leave it to Beaver fame) kept separate bank accounts during the ‘idyllic’ 1950s. I’m still wondering what Mrs. Cleaver did all day while Ward went off to work. Anyways…

Positives: Do you and your partner have very different money habits? Divvying up the dough across separate bank accounts may be the best solution when one person is a saver and the other likes to spend everything in sight. Separate finances may also be a solution for remarried couples who pay child support or alimony since it can be easier to earmark certain funds for previous family commitments. This system also works well for responsible couples who just like managing their own money.

Negatives: Better check your bank fees or switch to a no fee checking account ’cause the cost of keeping multiple accounts can add up fast! Separate checking and savings accounts can also make paying bills and shared expenses a hassle, especially when neither partner is financially flush enough to cover a surprise car repair. This method requires a lot of division and discussion to cover all the costs — perhaps all the open discussion is a good thing!

Five Rules for living together (and loving each other) with separate bank accounts.

- Set Spending Limits. Discuss an expense or splurge if it’s over an agreed upon limit. For example: $25, $50, or $100.

- Proportional Paying. Divide the bills (and debt) based on each person’s total income. For example: June pays 10% less on the cable bill since she earns 10% less than Ward. Or June pays for heating while Ward foots the phone and cable bills.

- Monthly Updates. Run your household like a business by holding monthly (or quarterly) financial meetings with your spouse. Go over each and every account to ensure the flow of cash is working, or see if adjustments need to be made. For example: Perhaps June scored a raise and should now contribute more to the mortgage. Yay June! Use the Free Budget Spreadsheet for tallying the bills and dividing the dough.

- Keep a ‘Mad Money’ Account. Set some savings aside for fun. Each partner should save a little dough on the side for those sexy shoes or new gadget — no questions asked!

- Budget for Emergencies. When keeping separate accounts it’s important to put money aside for emergencies. A dedicated ’emergency fund’ account may be the ticket your partnership needs when times get tough and neither partner is flush with funds. See How to Start an Emergency Fund on Any Budget for the details.

3. Together Yet Apart: A Combination of Both

When you can’t decide on the best money management approach for your pairing, then why not split the difference with a combination of bank accounts? When each partner keeps a personal account along with a joint household account, it’s possible to keep autonomy while being together.

Positives: If you’re dealing with debt — credit cards, student loans, etc. — then a combination system can give you the flexibility to pay it off on your own. Maintaining separate accounts also gives each person a little privacy with ‘fun spends’ and splurges without having to explain the expense to their partner. Just be sure to contribute your set amount to that joint account so all the bills and expenses can be paid on time!

The combination system can also bridge the distance when there’s a big difference between spousal incomes. If proportional paying (or financial equality) is important, then each partner could contribute the same percentage of their income to the joint account. Easy.

Negatives: Get ready for a heated discussion on which expenses are paid from the joint account. “Sorry honey, your new Fluevogs are cute, but they’re not a joint expense!” fails to make for a peaceful dinner date.

Your Thoughts: Do you keep separate bank accounts, or do you merge money in a joint account?

This is something my BF and I have talked about and agreed on, so I thought I’d put it out there in case anyone is in a similar position.

We have *wildly* different spending habits. He dislikes tracking his money, and he will happily spend $50 for lunch if it’s a good lunch. I track everything, and I put most of my money towards savings and student loan debts. So, we’ve agreed on something like the third option. We each have separate chequings and (in my case) savings account, but we hold a single join chequing and savings account as well. All bills are split down the middle and paid from the joint chequings account, and we’ve agreed to each contribute $100 a month towards the joint savings account — this is for expenses like new furniture, etc, that we both need. However, outside of what’s split down the middle, we have no say in how the other spends their own money from their private chequings accounts.

This has worked out really well for us and saved a *lot* of arguments. I can save as much as I want, he can spend as much as he wants, and the bills get paid.

My wife and I have the simple joint account. We also use a budget tracking system (Mvelopes). SO, there are categories like debt, house bills, “consumables”, etc… that both of our incomes continually fund BUT we also both have our own allowances to make whatever purchases we want on our own. As long as we’re not going over what we’ve saved in our own allowance pools, there’s nothing much to talk about.

I think I’ve tried all three, now. My wife and I first started “living” together by going traveling for 5 months, and had completely separate bank accounts. I kept a spreadsheet detailing all the cash withdrawals and (less common) credit card payments each of us made and then subtracting any purchases that were clearly individual purchases. This worked pretty well (though my wife often seemed to feel that her turn to pull money was coming up disproportionately often…I think at the end of the trip she accepted that we’d split costs pretty evenly.

That worked well at the time, when most spending was joint, and we weren’t super concerned about the details of where money was going, just the rate at which we were spending.

________________

When we got home, we added a joint account to the mix, to pay rent, utilities, groceries etc. We put money in equally (we had very similar incomes at the time), but because my wife had student loan payments and I didn’t, I always had more money in my bank account than she did. Which also meant I’d make up any shortfall in the shared account because I was the one who could afford it.

It also meant that the small amount of money going towards rebuilding our savings didn’t grow very quick because it’s a lot harder to invest two sets of $250 separately than one block of $500.

This was administratively complicated, involved expensive bank fees, and didn’t give a significantly different result from a single joint account. It lasted about 8 months.

________________

Finally we moved to the joint account phase. I think you’ve covered pretty well the advantages and disadvantages above, so I won’t repeat too much. I will point out that holding a separate bank account does not reduce your spouse’s claim on “your” assets in the event of a divorce, so I don’t see how this can be a concern.

It helps that both of us have similar spending styles, though my wife has less interest in tracking. We need to work on our communication, though I try to make sure she’s informed about where we’re standing.

But, for Jade and others that use separate accounts to try to reconcile wildly different spending habits: how is this more than a deferment tactic? What happens when you reach retirement and your spouse is broke, but you’ve got enough to enjoy life to its fullest? “Sorry, honey, I’m going to Italy. Guess you should have planned better!”?

Even along the way, there’s going to be major purchases that are going to be difficult to manage, like buying a house, if one person has savings and the other doesn’t.

Overall, I just think that a couple that can’t think of themselves as a single economic unit is going to have a hard time getting all the way through life together. Having separate “fun” accounts might work, with the vast majority of money including all long term savings being joint, but living separate economic lives seems like it’s going to hit a wall at some point.

Separate accounts work fine as long as both people are making money.

A friend of mine in college had separate accounts with her husband. He paid the mortgage, she bought the food and paid the utilities. Worked great for them.

Until they had a kid.

She was taking out loans to pay for groceries while he bought a jeep (in addition to his other truck) and a waverunner. The whole situation was unbelievable to witness.

@Neil: my aunt’s now-ex-husband took all of the money out of their joint bank account and left. It wasn’t a matter of him having a claim on it when they divorced — it was gone before they ever got to that point.

But with regards to the pros and cons listed in the post: why would different incomes be a negative for a joint account (“This method also challenges couples who make wildly different incomes since one earner may be footing a proportionally bigger chuck of the bills.”) but be a Rule for separate accounts (“Proportional Paying. Divide the bills (and debt) based on each person’s total income.”)?

All that said, we have all joint accounts. Little splurges are not an issue unless we’re in a crunch, but we’re rarely in crunches, and neither of us splurge all that much anyway. I take care of the books and the bills, but he checks in frequently, and all major decisions are made together. It has worked for us.

As you alluded to, might be a generational thing. My wife and I have been married close to 17yrs and have always maintained joint banking and investment accounts, other than registered accounts that are by nature in single names.

We refer to our joint entity as “The House”. We both work towards growing The House and in return The House pays the bills, maintenance, etc. Something like clothing is a House expense.

Contributions to RRSP’s are done to maximize the tax impact. Likewise for donation credits and capital gains.

We do each have personal subaccounts (free at BMO) where, every year, we each get an allowance for “whatever”. Expensive frappachinos habits come out of the personal accounts. Brown-baggin lunch is covered by The House but eating out would be personal.

Yes, we might be weird, but it works for us…8-)

My husband is a spender; I am a saver. It took us a while to figure it out, but a combination of the two actually work best for us. We have a joint checking and savings account and he has a separate checking account. Every paycheck, he takes out a set amount to deposit into his account while I get the rest to pay bills and pay down debt. It works out quite well for us; I still feel like I’m in control and he doesn’t feel like he’s being micro managed.

My husband and I started out with separate accounts because I was 29 when we moved in together and independently financially established. But then when we had a baby and I became a stay-at-home mom we made it a joint account since I had no income for three years. Now I have a part-time income which is much lower than his but we kept the joint account.

We don’t have a problem with “I pay more bills than you” or trying to make everything “even”. It’s an unspoken rule that I work less so I do more housework/domestic stuff and he works more so he does less around the house. He makes 90% of the money so I take care of 90% of the household stuff (paying bills, repairs, cleaning, etc.) If one of us wants something expensive we just talk about whether or not we can afford it. He wants a new computer – we see if we can afford it. I wanted a kayak, we looked at our budget to see if we could afford it. It helps us a lot to not keep track of “who got more toys this year” or anything like that. We figure part of being a team is that each of us gives more or less in different areas so it all balances out in the end.

My boyfriend and I go with option #3.

Its not that I dont trust him, but I am very savvy and smart when it comes to my money and he needs to learn how to be also and be responsible for his own personal debts.

We have one joint account where we pay our monthly shared bills and the rest is our own to do what we please.

We split things like dinners, and gifts for other people and its worked out this way for 5 years!

I often say that when we get married that we will join everything together, but I honestly dont see a reason to do so if this works for us.

QUESTION: What would you do if you had a child to take care of? How would you divy up those expenses?

Why do you “SEPARATES” even bother staying together?

I may be an old fart, married 39 years and two kids fully fledged, and somehow we managed most of that time on one joint account.

My wife and I have wildly different spending priorities yet we seldom if ever got into an argument about purchases. Although I have managed the actual finances, since we trust each others judgement, the only question she ever asked was can we afford $xxx right now. I did not need to know the details.

We had joint priorities agreed upon before marriage, she would stop work to raise the kids, we would pay off the mortgage asap, get the kids thru university and save like hell for retirement (in roughly that order) while enjoying a reasonablly comfortable lifestyle.

IMHO the only reason she got a separate account about ten years ago was to create paper trails for attribution in investments, in order to minimise taxes, now that we are both retired.

Possibly we are throwbacks to an earlier age, no test drive of living together, we were young by todays standards (19 & 24) but I know that I was extreemly lucky in my choice of mate.

If you have a joint bank account in Quebec and one of the parties to that account dies the account is frozen until the will is settled. We’ve always had separate accounts and our notary says it is better to keep it that way.

Another example of the distinct society.

Seperate accounts worked well for me. We split the bills then had no arguments whatsoever about how the other spent what was left of their money. And when it ended after 10 years, it was a pretty clear-cut settlement of property.

We do the third option. The joint account it for rent/hydro/ and combined bills. Simple as that. I’m not sure why so many people get all flustered. Nothing comes out of the joint account that isn’t a bill.

Anything I buy for myself personally is my purchases for clothing, food etc.

I was a single mother when I met my late husband (after 31 years of marriage, passed away 5 years ago.) I always kept my maiden name and separate bank account as did he. For “our” stuff like bills, savings, groceries we had a joint account. Every month we would put an allotted amount (for the times, because as the years go by, you should adjust your money accordingly) If we wanted to purchase something from our own accounts or needed something extra, we were considerate enough to ask, but didn’t “have to” have permission from the other. Special gifts or meals were never a problem. And my daughter was never “begrudged” anything whether it was his money or my money that paid for whatever. As for us “SEPARATES” that never once came up in did I mention 31 years of being married? That’s what worked for us and as a point of fact that when my Husband passed away suddenly 5 years ago, there was less of a difficult time settling his matters Because everything was clearly defined. We bought houses, put the kid through education, invested and did everything buddy did. For our purposes, that’s what worked. What may have “shaped” my future financial “selfishness” is that I went with my mother to the hospital when we thought my father was going to die and she threw the checkbook and bank statement on the bed and demanded to know how to manage the money!!! That was an era where the men DID look after the women, but that way of life should be long gone by now….and if you are doing your money thing that way and it works for you…well good for you

We use a single joint account. We budget money in this order: (1) essentials, (2) fun money ($X each per month), and (3) debt and savings. If I don’t spend my fun money, or she doesn’t spend hers, it just rolls over to the next month, accumulating.

“I worked hard for this money, I should be able to spend it however I want.” ~ Deluded and Divorced

Karen : Sorry for your loss and congrats on your successful transition.

You are absoutely right, “that era should be long gone”. If you knew my wife you would know “that I am not looking after the ‘little woman’ “. Although I handle the finances (with her blessing), she is more than capable to take over when she has to and everything is documented for her to hand to a financial advisor (she hates investing).

I guess it just comes down to different strokes for different folks and each of us is moulded by our times and experiences.

We started out with the separate accounts and splitting based on income. Picking the type of ‘method’ may also be a factor of how similar you and your partner are in spending/ saving habits. Once we got a mortgage we moved to mainly using a joint account – however we have a joint account that requires two signatures for any cheques or withdrawals (married 21 years, love and trust my spouse, but I’m cautious by nature). Everything is paid out of the joint account, but all major purchases are discussed and savings goals were discussed and set. Fortunately we have similar spending habits (if you don’t have the money, you don’t spend it) and I’m the familty ‘bookeeper’. I’ve always believed that the biggest strains on a marriage and what should be well discussed are: how money will be managed and the children/ no children issue.

I wonder if the separate income trend is due to the the higher divorce rate, or maybe a CAUSE of it?

I always recommend married couples consider their finances to be joined no matter how many accounts they might have. There isn’t “mine and yours” any more, only “ours”.

If a couple is just co-habiting, then keeping finances separate until some kind of commitment (formal marriage or otherwise) is made is a good idea.

Technically we’ve been cohabitating, but practically speaking, since I refer to his parents as “my in-laws”, we might as well be married. We have a joint account for fun things, and for now (hopefully…it’s a tough job environment these days, eek) he gives me money every month to see to the consumables we use (typically, I cover groceries-and-things). But otherwise we keep our finances separate. I think it actually works better this way–I don’t want to know how much he spends on things that I don’t have an opinion about one way or the other, and I’m pretty sure he doesn’t want to know how much I paid for my camera.

Kerry and everyone –

I would love to hear your opinion on how to handle finances where there are kids (two or three ie enough to keep a wife busy) and the wife is not working, or even in the case where the man’s salary is significantly (three or four times) higher than the man’s salary.

I spoke with my mother about this very topic the other day, as I am looking down the barrel of the marriage shotgun with my current girlfriend. My mother and my father have a system that has worked for them for almost 40 years now. She said that it’s just something that couples have to work out together, and the reader comments seems to back this up.

What worked for my parents was my father being the bread-winner and also paying all the bills, giving money to my mother whenever she needed it. He also took care of large investments (although my mother did have a say in them, usually “that’s the worst idea I’ve ever heard.”) My mother was responsible for the “small” investment decisions, such as the colour and fabric of the curtains and cushions.

At least since the major loans (house and first investment) were paid off my father would have never said ‘no’ to a request from my mother for money. These days she sends money home to her mother, and of course my father has no problem in handing it over (although my mother doesn’t like to ask). Of course, it helps that my mother has never had a lot of demands like brand name handbags and their ilk.

Thinking this was the best system, I slightly shocked to hear that my girlfriend had different ideas, bringing up “joint accounts” and all these things I’d heard of but never really seen how they fit into the big picture.

The first major difference was that my girlfriend happens to be Japanese, and in Japan the “default” system is as follows: The woman is a full-time housewife, and the man hands over the entire paycheck each month. From this, he receives a small weekly allowance for things like beer, gambling and cigarettes (although it is not uncommon for guys to save their money over a few weeks and hit up a prostitute or erotic massage parlor), while she “manages” the rest of the money. This includes paying bills, buying handbags, going to Korea with her friends to watch her favourite Korean boy-band, buying 20 year government bonds, shorting the yen to buy AUD, etc.

Needless to say I was a little concerned about making the switch to this system, but when I asked my mother about it the other day she said that even back home there are families (with one bread-winner) who operate on a similar system. The one slight difference may be that instead of handing over the entire paycheck first and then begging for spending money, the man would typically take out what he would be needing for the week, and then hand over the rest.

Then the rest of the formula is similar to what some of you have described above: discuss the big purchases.

Anyway, as I mentioned I’d be more than happy to hear the experiences of some of you non-DINKS with regards to how you divvy up the treasure each month. Also, what’s the split of housework for those of you who have both one or two working partners?

AB

I feel very strongly that nothing but a joint account will work in a successful marriage.

When you are married you should be building a life together. This is why all the comments about “I’m a saver, they’re a spender, so we have seperate accounts” DO NOT make any sense and will eventually not work…

Think about it, is the “saver” of the family going to retire and the “spender” going to work until they die? How are you going to plan your golden years together?

The argument that you will avoid fights over purchases your partner won’t appreciate is RIDICULOUS. In a marriage you should be accountable to the other person for your spending…It’s called trust and it’s what makes a successful marriage.

I am a CFP and HOUSEHOLD financial planning only works if couples manage their finances TOGETHER. For examplt, no sense of a spouse in a 30% tax bracket to make RRSP contributions if the other spouse in a 46% tax bracket; it’s about planning your future TOGETHER.

Also, what about if one spouse takes time off to raise children, are they now going to have to beg the other one for money for basic things because they are not working??? It’s stupid!

Money is the #1 reason why couples break up; if you do not trust your partner enough to manage your finances with them you might as well break up now!

@Another Brother: We use basically the Japanese system you describe, only we both get the same monthly allowance. Everything else goes in the pot for bills, debts, savings, and joint purchases. We both find this a very relaxing system: it’s very fair.

This was a helpful article, though a bit biased against joint accounts (understandably, since that is not your style). My husband and I have kept joint accounts ever since we got married, but that does not mean that we don’t keep track of our respective incomes or spending habits. Your list– “the Five Rules for living together with separate bank accounts” absolutely applies to couples with joint accounts (with the possible exception of #2, “proportional paying”), and this type of open discussion is an important part of our success financially, and as a couple.

Well, Charlie, you’re WRONG. My parents were married in 1951, kept seperate accounts and were happily married untill my Dad died. What works for you is not what works for me or my parents or 48% of the nation. You’re obviously young (which is a great thing–but you don’t know everything) and have that naieve belief that you know everything and everyone should be just like you. YOU”RE WRONG. A little more expereince will show that there are many different types of people in the world and it’s best when we understand that and don’t get egotistical with absolutes. I’m 50 and have always had my own accounts, always will. My husband keeps his ‘play’ money and I keep mine. It works great for us, but were were older when we got married, so we’re more able to let people be what they need to be rather than trying to force everyone into our rigid box.

And I meet my my financial planner every year (on my birthday) and he doesn’t find it ‘wrong’ that we keep our finances seperate. He learned about our situations, and crafts a plan that works for our lifestyle. Smart guy.

Beth,

I would never tell a client I think it is “wrong” that they have seperate accounts.

Your situation is different since you met when you are older and may be in a second marriage and you both may have children from a previous marriage and you both may have accumulated wealth already that you want to keep seperate. My advice is targeted toward young people starting out.

My point is for young peole starting to build a life together, and I am telling you that by keeping seperate accounts they are missing out on a ton of efficiencies that can be created by keeping everything joint.

Beth can you also please explain to me (again for people starting out):

How there can be trust in a marriage, yet you want your own accounts so your partner does not know what you are spending your money on?

How can you plan your golden years together if one person doesn’t want to commit to a savings plan and the other does?

How can these seperate accounts and bill splitting arrangements work if one spouse decides to stay home to raise children? Will the other spouse decide a fair “salary” for domestic duties?

Also you are correct, I am young 29, however with no handouts at all (from family, inheritences, lottery, etc..) my wife and I have paid off our mortgage and put another $100,000 away in savings already; our net worth is approaching $500,000. So well different things work for different people, money is finite and their are good and bad ways to manage your money. With the wealth I have built at my age, without any handouts at all, I must be doing something right.

Finally, money is the #1 reason people divorce, so I stand by my original point, if you don’t understand and accept your partner’s financial situation and habits towards money before marriage, you’re in for a bumpy ride.

I would never consider marrying someone I don’t trust 100% with my life savings; gold diggers need not apply.

Beth,

Also, as I have been a financial planner for 6 years now and I have worked with a lot of young families and seen lot of marriages end.

The typical scenario is seperate bank accounts where each partner spends their “own” money and they split all common bills (mortgage or rent, utilities, etc…). Everything works fine until kids come around.

Kids come, income goes down, bills go up and fighting over allocation of resources begins because either spouse is used to “justifing” their expenditures; then 60% of the time comes the divorce. I have seen it happen many times.

There are benefits to both individual AND joint savings accounts. Obviously, pooling your money for joint expenses and paying them from one account is the easiest, but having your own money set aside in your own account has it’s benefits as well. One thing to keep in mind – in the event that (heaven forbid) you should ever be forced to declare bankruptcy, spouses are responsible for each other’s debts ONLY is cases where accounts are held jointly.

It’s really about what works for the couple and serious communication no matter what you’re doing.

My husband and I have joint accounts (made sense since we both barely had any money when we got married) but we keep separate ‘allowance’ accounts that we contribute a set amount to every month and we’re allowed to spend however we want. Birthday and holiday money also goes into the allowance accounts.

Also, I don’t understand bank fees. Why on earth wouldn’t you use a no-fee credit union? Ours doesn’t even charge us overdraft fees, if we happen to overdraft (which doesn’t happen much any more) it just goes straight on our credit card (also from the CU). Maybe our CU is unique.

My dear mom always told me “…don’t ever have a joint bank account…”. The unusual thing about this statement is that it was made to back back in 1969!! My mom was ahead of her time.

I’ve been married since for over 26 years now, and my husband and I both worked (we’re now both retired from the military). We have a his, hers, and ours set-up. We each contribute HALF to the mortgage, utilities. He pays for all car expenses. I pay for various life insurance policies. We each pay our own credit card bills. Works great!! No arguements over cash — and we both have nice retirement bank accounts. Win-Win. 🙂

I just have to jump in with “that era should be long gone” of the man looking after the little woman. That is a very harsh, judgmental way to look at other people’s lives. I am an independent, strong woman who made a choice that my job was raising my child first and foremost. Just because I’m not working at a paying job more than 10 hours a week right now and my husband pays all the bills doesn’t mean that if he died or left me right now I couldn’t get a full time job ASAP and support myself.

The idea that if you take your husband’s last name and choose (as a well-educated, successful-at-your-career woman) to stay home with your children means that you are weak or old-fashioned or just plain wrong is horrible. There are no “woman’s rights” in that attitude. It is an attitude that the way you live and the way I live is wrong. That is just an oppressive an attitude towards women as saying that a woman belongs barefoot, pregnant and subservient.

I make my own choices and that makes me independent. I chose to be a (mostly) stay-at-home mom with my husband’s last name and that was my independent choice. Don’t try to oppress me with your labels or out-dated-faux-feminist self-righteousness.

Julia: Please re-read that post and the one that prompted it.

The message I tried to convey was one of equality in a marriage, not leaving one partner out of the decision making. If you cannot see that, I am sorry I offended you.

My husband and I go with option #3, we each have our own separate chequing and savings account, but also joint savings and chequing accounts. Him & I make close to the same amount each month, for now at least, so it’s pretty even. But even if I did end up making significantly more than him (which might happen in the near future) then it wouldn’t bother me that we’re splitting the joint expenses 50/50.

Our wages/salaries are paid into the joint account and each month we both get an “allowance” transferred into our personal accounts (a whole $400). Our RRSP contributions are taken out of our joint account as well – we both contribute the same amount every month so it works.

My husband is terrible with money and I’m a huge saver, so this was the best solution for us. We get an equal amount for the “allowance” each month, I save quite a bit of mine and he spends most, if not all, of his. He does know that if he ever wants to buy something expensive for himself, he will have to save the money.

We agreed that joint expenses include all our bills, groceries, mortgage and any time we go out when both of us are there.

I find that once we put this into place we end up with tons of money leftover at the end of the month (where previously my husband would have found a way to spend it), which we’re now saving for travelling and buying new furniture. I’m quite excited 🙂

Any thoughts on when one spouse has a history of gambling? No need to suggest divorce – we are working on counseling first. I’m just looking for financial ways to move forward together yet protect myself and our son at the same time in case in the end it leads to divorce.

My husband and I are in our 20’s and we’ve had joint bank account since we first moved in together when we were 18. I just don’t get having separate accounts, it doesn’t make sense to me. It makes things complicated, and if one person makes more than the other, having to calculate who puts in what percentage of the bills per month is a huge pain! We’re partners, and it makes it much easier for all our money to be in one pool. We trust each other, and if there’s something over $50 we want to buy, we’ll discuss it with each other first.

I’ve been married 40+ years and hubby and I have always had joint accounts. We have the same beliefs re: spending, saving, investing. I pay the bills and keep the books and sit down with him regularly to share “where we are” financially. This has worked for us, but that doesn’t mean it will work for everyone, as evidenced by the above comments.

I think the most important thing for couples is to have a plan and work it. Whether marrying or living together, this should be discussed ahead of time and a plan devised. As time goes on, rework the plan as many times as necessary until it works satisfactorily. It will have to be reworked as circumstances change anyhow: job loss, salary changes, birth of children, etc. Just have a plan!

I have tried all three systems and my first wife spent so much that we always had to worry about paying taxes at the end of the year when we made good enough money to not to have saved enough for this. She didn’t like having to answer about spending and we agreed to get the other’s approval for purchase more than $100 but if the money was there, it got spent in small chunks here and there and we could never save because she handled the checkbook and bill paying but wasn’t good at saving money. After we divorced, I never sweated paying the taxes at the end of the year.

Now on to my second marriage and lessons learned from the first. When you remarry and each have kids and bring your own debt into the marriage, the best way I feel to handle this is to have a joint account for the regular bills and separate accounts for you mad money and paying off debt. That way there is no fighting about money spent on one child vs. the other or whose debt gets paid first.

Ideally, we plan to have one joint account later after the kids are grown and our own individual debts are paid off.

My husband and I have joint accounts only. However we both get to withdraw $xx each month and do as we please with it- we dont have to explain any of our spending to eachother. Works out great- we dont pay extra banking fees and I personally find it much easier to manage cash than virtual money.