I’m having a little frugal media fun this month and you’re invited to the festivities. Ok, it’s not like I landed the cover of Vogue or got ranked in Forbes or anything — the day any of these happen will likely be April 1st — but hey, I’m working with what I’ve got here, and that’s an honest blog, a big-eared dog, and my naughty noggin. So let’s get to it.

MoneySense Magazine

I wasn’t a normal kid back in school. While my classmates were doing Cosmo quizzes and poring over the pages of various fashion rags, I was securely crazy-glued to “MoneySense Magazine”, a fine Canadian personal finance read.

So when MoneySense writer and managing editor Sarah Efron shot me an email request to share my money-saving ideas in the April issue, I did a happy dance on top of my tall stack of back issues.

I nearly fell over when I saw the April cover story — ‘Save $750 Every Month: 62 easy ways to save without sacrifice’. Plonk! This mega bonus issue covers everything from saving money on food to cutting insurance costs.

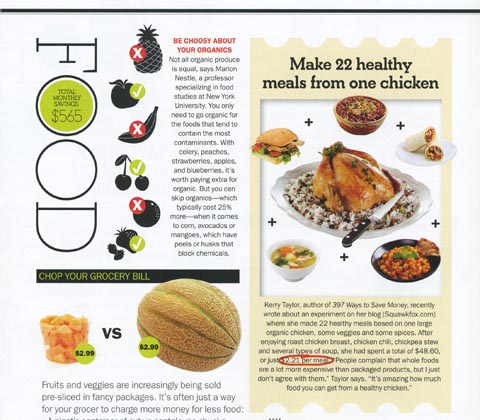

My clucky chicken stretching experiment (1 Organic Chicken, 22 Healthy Meals, $49 Bucks) even got a sidebar mention. How cool is that?

Anywannabecovergirl, I’ll link back to the story if/when it’s posted online. I don’t think my American readers can hit the news shelves for a copy (sorry), but my fellow Canucks can certainly pick up this month’s edition in stores across Canada.

The Globe and Mail: Me & My Money

It’s usually a bit of a sausage party over in ‘The Globe Investor’ section, so I’m thrilled to see a lot more women invited to talk about cash for a change. The last three interviews for the Me & My Money column have all been gals, myself included. Yay!

Read the story: Me & My Money | Investing on the cheap

Sharing my investing style and portfolio composition with financial journalist and former economist Larry MacDonald was the easy part — I’ve been a fan of low cost ETFs and a foe of investing fees for years. What’s tough is reading the peanut gallery responses, and seeing some snarky anti-female comments fly. Like this one:

“Guess she missed the ultimate thrifty move of an attractive girl just out of college. Find a rich guy and give him all your bills!”

That’s a load of crap, and completely opposite to everything I believe in. There are some amazing responses too though — take this one:

“She paid off $17,000 in student loans within six months, saved up ‘six-figures’ by her mid-thirties. Wow, that is seriously inspiring. Good work.”

I would love to see more women (and men for that matter) get brave about their financial failures and triumphs, and feel secure enough to share them with others. Otherwise, money remains a taboo topic and we don’t grow past polite conversation. So I’m asking you for a small favour: If you have a Twitter or Facebook account, I’d love you to click and share my interview with others ’cause I’m a real person taking about real money. Not everyone is born with a silver spoon up their butt and most people could use some real conversation from an honest investor for once. Thank you.

Toronto Star

Is there such a thing as smart borrowing? That’s the million dollar question financial journalist Paul Brent asks in his Toronto Star story, Some debt is good, but most is dumb. I love it!

In this article a few money experts discuss their rules for debt. I just share why I’m debt averse. Now stealth Squawkfox readers will wonder about that doggy in the photo — ’cause that’s not my blue heeler, Pivo. To be honest, I have no clue whose dog I’m petting. I have a random habit of stopping for all friendly hounds, so if that’s your dog, my sincere apologies for smooching your pooch in public without permission. He is a lovely hound though.

Globe Special Report

Ok, so this story ran way back in February, but it’s online and ready to read for free. In Why choose a TFSA over an RRSP? financial journalist Paul Brent talks to a few bloggers and real Canadians about their registered investments.

This story may feature a big photo of me, but it’s about Kim Petch, the blogger behind Balance Junkie.

No joke here: Hope you enjoy this month’s money articles — you’d be a fool not to check them out. 😉

Congrats on the media frenzy. As for your picture on the article rather than mine, I was grateful for that … and I’m sure many other readers were too! 😉

“… most people could use some real conversation from an honest investor for once.” I think your Me & My Money profile delivered in spades. Thanks!

“Sausage party” – lol. You have a way with words. 🙂

You go, Gal! 🙂

Well deserved, superstar!

Congratulations Kerry!

This is the first time I’ve visited your blog, but I like it: it’s fun, creative, smart and visual. I could definitely take a few pointers from you!

Cheers!

Andrew

[…] an article highlighting some of the well-deserved media attention she’s gathered recently. In April’s Fool, she somehow managed to produce a witty summary of a number of articles that are well worth your […]

Congratulations, success comes only after hard work. I wish to be on news paper too for my blog one day…

SB, do you have email alerts? (I repost Squawkfoxe’s posts all the time). ~ Kelly

I have you on my blog roll Kelly. I read each and every of your articles..

Thanks, SB! I know which Kelly you refer – alas, I’m not her. But I follow you on Facebook and Twitter! 🙂

Thanks for the follow. I think all Kellys are great! Did you get a chance to visit my site? Please do so and do leave comments about what you feel.

I have you book-marked, SB, and will do so (leave comments) 🙂

Thank you so much Kelly!